The Daily Breakdown takes a closer look at the technical setup for Doge, while also exploring Polygon and Arbitrum.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 100+ cryptoassets offered by eToro. Today we’ll discuss Polygon and Arbitrum.

Polygon (POL): Currently trading near $0.12 with a market cap of roughly $1.3 billion

Polygon is a Layer-2 Ethereum scaling solution launched in 2017 (originally Matic Network) that uses sidechains and Proof-of-Stake to deliver faster, cheaper transactions for Ethereum-compatible apps. Its token — transitioning from MATIC to POL — is used for fees, staking, and validator delegation. Polygon is widely adopted across DeFi, gaming, and NFTs, supporting platforms like Aave, Uniswap, and OpenSea. The network is decentralized, utility-driven, and maintained by validators and community contributors rather than a central authority.

Arbitrum (ARB): Currently trading near $0.21 with a market cap of roughly $1.2 billion

Arbitrum is also a Layer-2 scaling solution for Ethereum that uses optimistic rollups to deliver faster, lower-cost transactions. The ARB token, introduced through an airdrop, serves as the governance asset for the Arbitrum DAO, enabling holders to vote on upgrades, treasury decisions, and ecosystem development. Supported by the Arbitrum Foundation and Offchain Labs, the network has grown rapidly, especially after its Nitro upgrade improved scalability and performance. ARB functions primarily as a governance and participation token — not a claim on revenue or fees.

Want to receive these insights straight to your inbox?

The Setup — Dogecoin

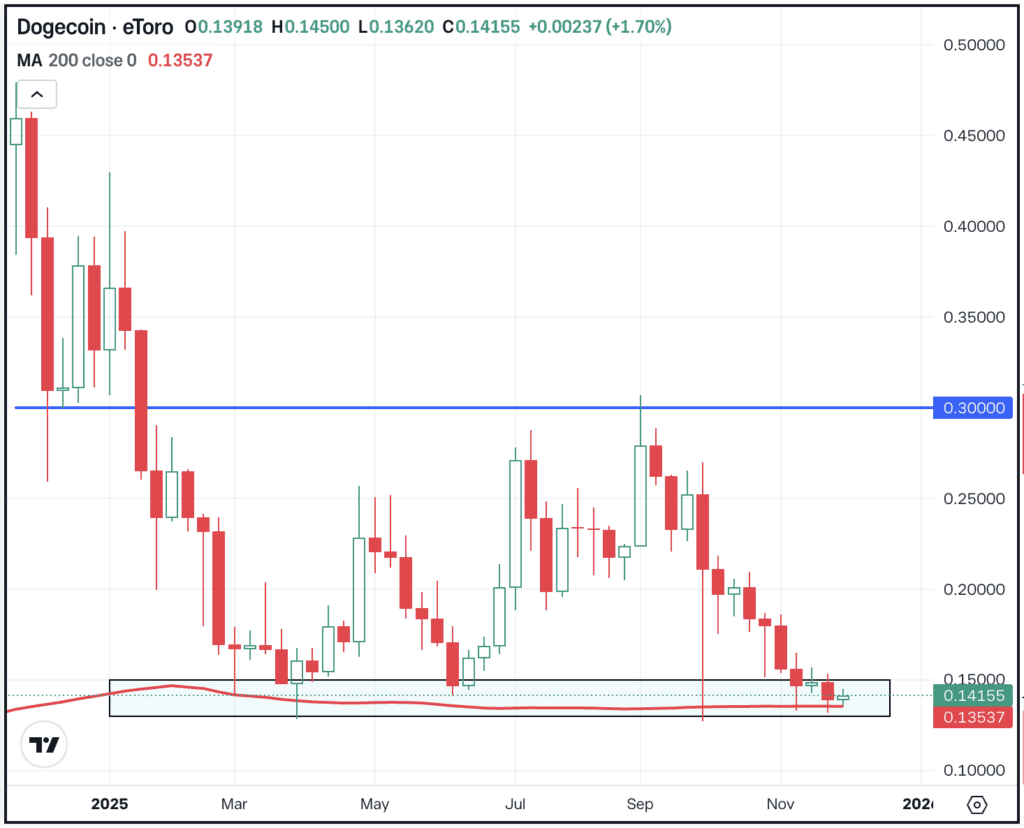

It’s not just Bitcoin, Ethereum, Solana and others feeling the pain in the crypto space. Smaller cryptos like Dogecoin have also been under pressure. Since breaking below the key 30 cent level earlier in this year, this level has turned into resistance — as we saw in September. Now though, bulls are hoping a key support level continues to hold.

All year long, the 13 to 15 cent area has been a major support zone for DOGE, which is exactly where it’s trading now. If this area continues to hold, bulls might look for an eventual bounce. However, if this support area breaks, then more bearish momentum can ensue.

What Wall Street’s Watching

Shares of Broadcom erupted higher on Monday, hitting a high $407.29 and notching a new record high. The company now boasts a market cap of $1.9 trillion, the sixth-most valuable company in the US, trailing Amazon at $2.4 trillion and ahead of Meta at $1.7 trillion. Broadcom reports earnings after the close on Thursday. Dig into the fundamentals for AVGO.

Netflix was again in focus on Monday, following Friday’s blockbuster news that it will acquire parts of Warner Bros to add to its vast streaming empire. Shares slipped another 3.4% as Paramount — another company that was bidding for Warner Bros — made an even richer offer. Check out the charts for NFLX.

Shares of Nvidia rallied almost 2% on Monday before gaining in after-hours trading on reports that the US government will potentially allow the resumption of select AI chip sales to China — with the US to receive a portion of the revenue. Advanced Micro Devices is also trading slightly higher this morning. Analysts expect almost 40% upside in NVDA from current levels.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.