The Daily Breakdown dives into Meta, which has underperformed the S&P 500 so far in 2025 as investors question its AI spending.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Meta Platforms is a collection of social media and communication applications, with its core Family of Apps consisting of Facebook, Instagram, Messenger, and WhatsApp. The company’s Reality Labs segment develops virtual and augmented reality hardware, software, and content to support immersive experiences.

At one point, shares were up roughly 36% on the year — and more than 65% above the April low — but after the recent pullback, they are now up just 11.5% in 2025. While that performance is not necessarily bad, it does trail the S&P 500’s year-to-date gain of more than 17%.

So what went wrong?

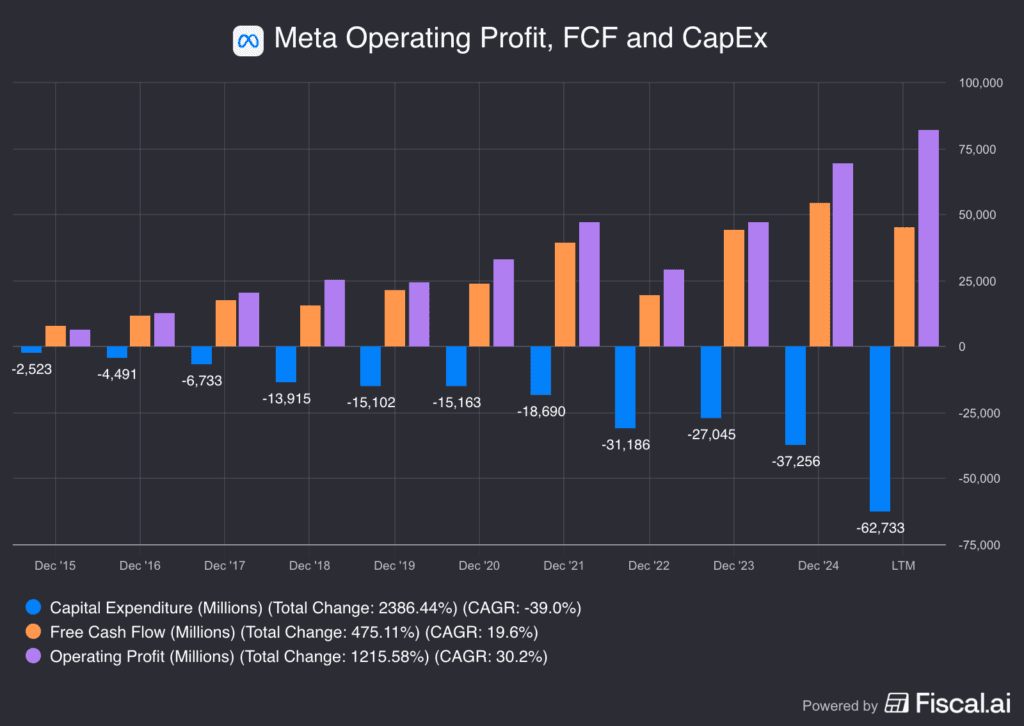

Meta has been on a major spending spree, with capital expenditures surging as it invests heavily in AI. Other large tech firms, including Microsoft, Amazon, and Oracle, are also spending aggressively, but investors have been more willing to punish Meta for its pace of investment. Arguably, that reaction is healthy, as it suggests investors are enforcing some level of fiscal discipline. Case in point: Meta shares rallied on news that the company was reducing its metaverse investments.

As the chart above shows, operating profits continue to climb — a sign that the underlying business remains strong — but rising capital expenditures are weighing on Meta’s substantial free cash flow.

Future Growth Projections

Here’s where it gets interesting. Analysts expect a slight earnings decline in 2025, but once the company moves past that year, forecasts for 2026 through 2028 call for double-digit earnings growth in the mid-teens. Revenue growth estimates are similarly robust. If Meta executes well, its valuation could move even lower as earnings improve.

According to Bloomberg, analysts project the following:

- Earnings Growth: -5% in 2025, 15.9% in 2026, and 14.3% in 2027

- Revenue Growth: 21.2% in 2025, 18.1% in 2026, and 15.7% in 2027

Analysts currently have a consensus price target of ~$830 on Meta stock, implying about 27% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

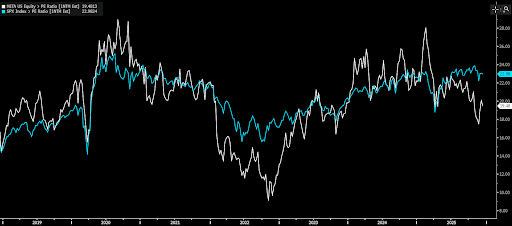

The S&P 500 trades at roughly 23 times its next 12 months of earnings, whereas Meta currently trades at about 19.5 times forward earnings. You can see how similarly the S&P 500 and Meta trade on this basis, with the latter making a notable break lower over the past few months.

Now bulls are wondering where the floor might be for Meta. In November, shares found support in the $580s — which represented a forward P/E of roughly 17.5x. Since 2020, Meta has typically established a support floor between 15x and 17x forward earnings expectations. On the upside, META shares tend to lose momentum around 28x. However, it is worth noting that during the last bear market, the stock traded at less than 10x forward earnings, so there is a risk that its valuation can move lower.

Risks & Bottom Line

Meta bulls are in a difficult position. On one hand, they want the company to invest heavily in its future so it does not fall behind in the AI race, especially as AI clearly benefits Meta’s underlying business. On the other hand, they do not want the company to overspend, although management has shown a willingness to rein in spending to protect the financials and ease investor concerns.

Market-wide volatility and an economic slowdown are risks nearly all companies face — Meta included. But as the company moves past a challenging year of comps (2024 was an ad-heavy election year), its growth hurdles should become easier. When combined with a reasonable valuation and solid long-term growth expectations, bulls may find Meta appealing. Still, others may argue for lower prices, pointing to elevated spending and a lower valuation trough as their justification.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.