MasterCard runs a high-margin business, but the stock has come under pressure lately. The Daily Breakdown dives deep into the situation.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Last year, we did a Deep Dive into Visa, referring to its business as a “toll booth” for credit and debit transactions. Mastercard is built on a similar model, although it is smaller than Visa, with a market cap of roughly $490 billion versus about $630 billion. Lately, the credit card industry has faced a unique risk from the White House — something we will discuss in more depth below.

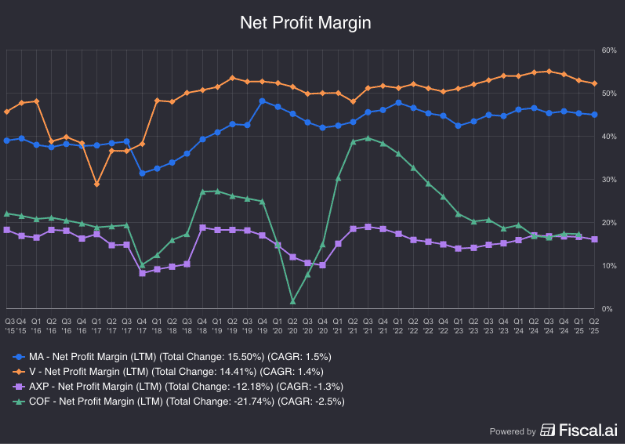

While there are other major players in the space — such as American Express, Capital One, and Synchrony Financial — they also operate as banks. Each model has its own pros and cons, but Visa and Mastercard typically command materially higher profit margins given their network-based business model.

Future Growth Projections

While Mastercard may not command as high of profit margins as Visa, it does have faster growth expectations. Whereas Visa is expected to grow earnings about 12.5% in 2026 and 2027, Mastercard is expected to grow earnings closer to 16.3%.

According to Bloomberg, analysts project the following:

- Earnings Growth: 12.7% in 2025, 16.3% in 2026, and 16.3% in 2027

- Revenue Growth: 16.3% in 2025, 12.5% in 2026, and 12% in 2027

Analysts currently have a consensus price target of ~$685 on MA stock, implying about 27% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

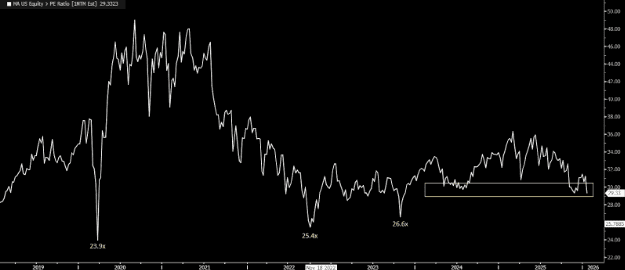

Over the last two years, Mastercard has found valuation support around 28x to 30x forward earnings, which is where it’s trading now. However, other selloffs, like the COVID-19 decline or the 2022 bear market, have sent Mastercard’s forward P/E ratio down into the 24x to 26x range.

Some investors might notice that Mastercard’s valuation is back down to where it was during its fourth-quarter lows — even though the stock price hasn’t retested those same lows. That’s because earnings estimates have slowly inched higher over the past few months. Remember, a P/E ratio is an equation — price divided by earnings. If earnings go up and the price doesn’t move as much (or goes down), the valuation moves lower.

Risks

Historically, Mastercard has faced a clear risk — namely, a recession that saps consumer spending power and weighs on transaction volumes. However, the industry is now facing a new risk out of Washington after President Trump argued that credit card APRs should be capped at 10%.

The key risk for the credit card industry is that a 10% ceiling would materially compress risk-based pricing and profitability, likely leading issuers to tighten underwriting and reduce credit availability — particularly for subprime borrowers — while also pressuring rewards economics and prompting a shift toward alternative fee structures or other lending products. It would also introduce implementation uncertainty (legislative pathway, timelines, and potential legal challenges), complicating planning and weighing on investor sentiment.

The Bottom Line

While potential risks out of Washington have increased, the path to implementing those policies remains unclear and would face multiple hurdles. Longer term, so long as the trend toward credit and debit transactions continues, the industry retains a structural tailwind, as reflected in consensus growth expectations over the next few years.

For some investors, this policy risk and sentiment shift may encourage them to avoid the credit card space — or, at minimum, wait for a more attractive valuation. Others may view the current pullback as an opportunity to build exposure to Mastercard, or for that matter, Visa.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.