The Daily Breakdown dives into the software selloff, taking a closer look at valuation, earnings expectations, and key technical levels.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Software stocks are being pummeled as concerns grow that AI could cannibalize parts of their businesses. For now, investors aren’t hunting for value — they’re indiscriminately selling the group, even though many leading firms remain fundamentally solid. Growth estimates have held up or moved higher, while valuations for several names are approaching, or already below, their long-term troughs.

In recent days, the selling has spilled beyond software. Pressure has spread to financial ratings firms, exchanges, cybersecurity names, and travel companies. While the decline may be nearing a capitulation point, the bigger question is less about whether this group can bounce, and more about whether a dark cloud will continue to hang over the space.

Technically Speaking

Below is a look at the IGV ETF, the largest software ETF by AUM. For reference, the top five stocks in the IGV ETF include: Microsoft, Palantir, Salesforce, Oracle, and Intuit.

Now down more than 30% from its all-time high in September, IGV is approving the $80 level. There it finds a zone that has been support for two years, as well as the rising 200-week moving average. That doesn’t mean the decline will stop right here, right now. But it’s a technical reference point for investors looking for a potential support area.

For a refresher on technical analysis, be sure to check out our recent Boot Camp.

Future Growth Projections

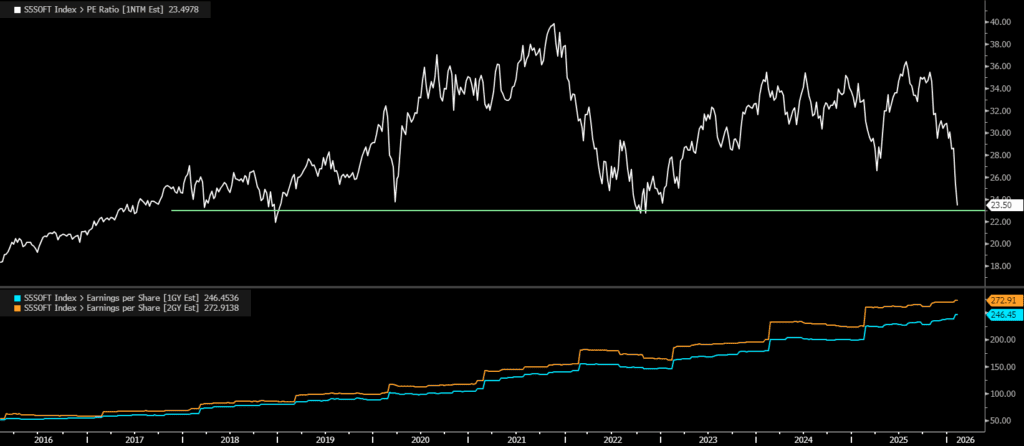

Looking at Bloomberg’s S&P 500 Software Index, analysts project solid growth over the next 12 and 24 months:

- Earnings Growth: 19.2% over the next 12 months, 14% in the following year

- Revenue Growth: 16.1% over the next 12 months, 16% in the following year

Want to receive these insights straight to your inbox?

Diving Deeper — Valuation

A closer look at the Bloomberg S&P 500 Software Index highlights two key points. First, valuations are nearing a zone that has provided support since 2018. That doesn’t guarantee this decline will make a low in the same area, but historically these levels have helped stabilize the group. Second, forward earnings estimates (the chart’s bottom pane) continue to rise for the next 12 and 24 months, even as stock prices have fallen.

Risks

Investors are reacting to fears that AI will upend software — and even adjacent industries. In the near term, the more extreme “existential” concerns look overstated. AI will evolve quickly, but demand for software and cybersecurity isn’t going away. The larger risk may be valuation: not whether these businesses survive, but whether the market is willing to pay the same multiples it once did. If the “valuation ceiling” shifts lower, upside could be capped even if fundamentals remain strong.

The Bottom Line

Some investors may stay on the sidelines amid volatility and the risk of multiple compression. Others will see high-quality businesses that have been repriced sharply and view this as a reasonable entry point. The market has overreacted to narrative-driven fears before. The question is whether that’s happening again — or whether this time is different.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.