The Daily Breakdown digs into Uber’s business, its turn to profitability, the stock’s valuation, and the risks that it faces in its industry.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

We know Uber as a premium ride-hailing service that operates around the world. However, the company has delved into multiple service offerings to bring more value to its end user. Uber operates out of three main business segments: Mobility (which connects riders with drivers), Delivery (which links consumers with restaurants, grocers, and retailers), and Freight (which matches shippers with carriers).

Shares hit a record high of $101.99 in September and recently dipped as low as $81.51, where Uber found key support. While it may not seem like Uber stock has been in demand, investors should note that shares are currently up about 50% so far this year. Part of that “low-demand” narrative is the idea that Uber will be a major loser — rather than a major winner — when autonomous vehicles (AVs) eventually gain more traction (be it from Alphabet’s Waymo, Tesla, or another entity entirely).

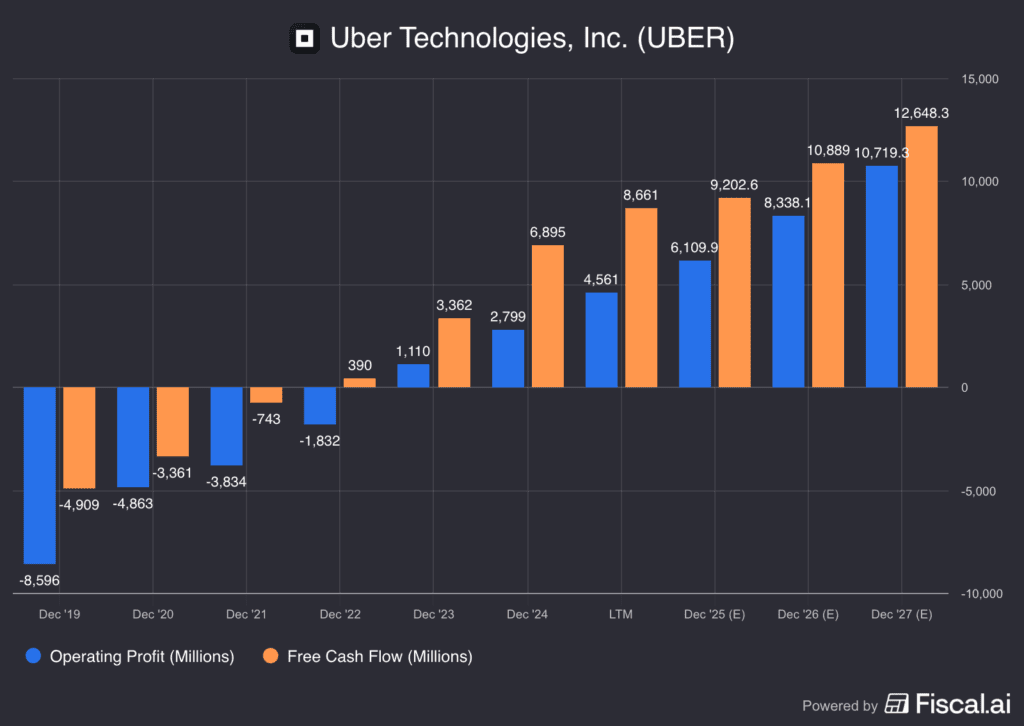

Uber Turns Toward Profitability

Uber has gone from $13 billion in revenue in 2019 to an expectation of about $52 billion in revenue this year. That’s good for a compound annual growth rate (CAGR) of ~22%. But perhaps more important than revenue growth has been the company’s turn to profitability. Notice on the chart above the way Uber’s operating profit and free cash flow both turned from negative to positive. Also notice how it has continued to improve each year over these stretches — and how they are forecast to continue in 2026 and 2027.

Future Growth Projections

While Uber has demonstrated strong growth historically, analysts suspect that there’s more gas left in the tank. According to Bloomberg, analysts project the following:

- Operating Income Growth: 100% in 2025, 50.3% in 2026, and 27.7% in 2027

- Revenue Growth: 18.1% in 2025, 16.4% in 2026, and 14.5% in 2027

Analysts currently have a consensus price target of ~$116 on Uber stock, implying about 28% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper

Uber stock has had a huge 2025 and has more than quadrupled from its 2022 bear market low. Despite the large move in its stock price, strong growth has kept the valuation in check.

According to Bloomberg, Uber’s currently below its average forward price-to-free-cash-flow (P/FCF) ratio of the last several years, while its forward price-to-earnings ratio (fP/E) remains in the low 20s, an area that marked a low point around this time last year. That doesn’t mean Uber stock can’t go lower, but the valuation might not be as rich as some investors may think.

Risks

Uber has clearly done well, both from a fundamental standpoint and in its ability to create value for its shareholders. But that doesn’t mean it isn’t without risks.

From its recent high to the recent low, shares tumbled 20% — showing outsized volatility vs. the broader market. Further, Uber’s ties to the travel industry exposes it to the cyclical nature of the economy. Should consumer activity slow, Uber’s business could slow too. (The opposite is also true though: should the economy accelerate, Uber’s business could see a boost). Lastly, while Uber very well could be a beneficiary of AVs, the market has continually treated it as a negative for Uber, so that risk could persist moving forward.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.