Microsoft stock has wavered notably from its highs and The Daily Breakdown digs into to see if there’s more risk…or more opportunity.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Does Microsoft really need an introduction? Probably not, but for those who are curious…

Microsoft develops and supports software, services, and devices worldwide. The company operates through three segments: Productivity and Business Processes, Intelligent Cloud, and More Personal Computing. The Productivity and Business Processes segment includes Office, Teams, LinkedIn, and Dynamics 365, providing productivity, collaboration, and business solutions. The company is also becoming a pretty big player in the AI arms race.

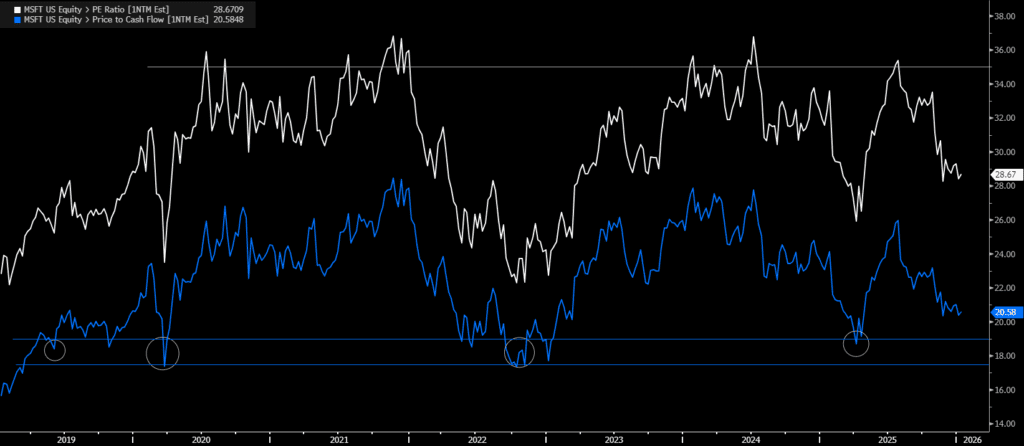

Big cloud players — like Microsoft, Alphabet, and Amazon — are prone to sizable sentiment shifts. However, these ebbs and flows allow the valuation to fluctuate between relatively expensive and relatively cheap. Let’s look at Microsoft’s forward P/E ratio (white) and forward P/FCF ratio (blue):

At ~28.7x forward earnings, Microsoft isn’t at a trough valuation, but it is well below the 35x level that has historically served as a valuation resistance area. Over the past few years, the stock has typically found a trough in the 26x to 29x range, although more extreme declines — such as the 2022 bear market and the COVID pullback — offered lower valuation opportunities.

On a forward free cash flow basis, Microsoft stock has found a trough between 17.5x and 19x. Shares are currently trading above that range at 20.6x, but that is down notably from the ~26x multiple seen this summer, which has tended to act as a resistance area.

Future Growth Projections

Microsoft’s fiscal year ends on June 30th, so we’re already halfway through its fiscal 2026. Over the next few years, analysts project annual earnings growth between 17% and 19% alongside 15% to 16% revenue growth.

According to Bloomberg, analysts project the following:

- Earnings Growth: 17.1% in 2026, 17.4% in 2027, and 18.3% in 2028

- Revenue Growth: 15.8% in 2026, 15% in 2027, and 15.7% in 2028

Analysts currently have a consensus price target of ~$631 on MSFT stock, implying about 32% upside to today’s stock price.

Want to receive these insights straight to your inbox?

Diving Deeper — The Technicals

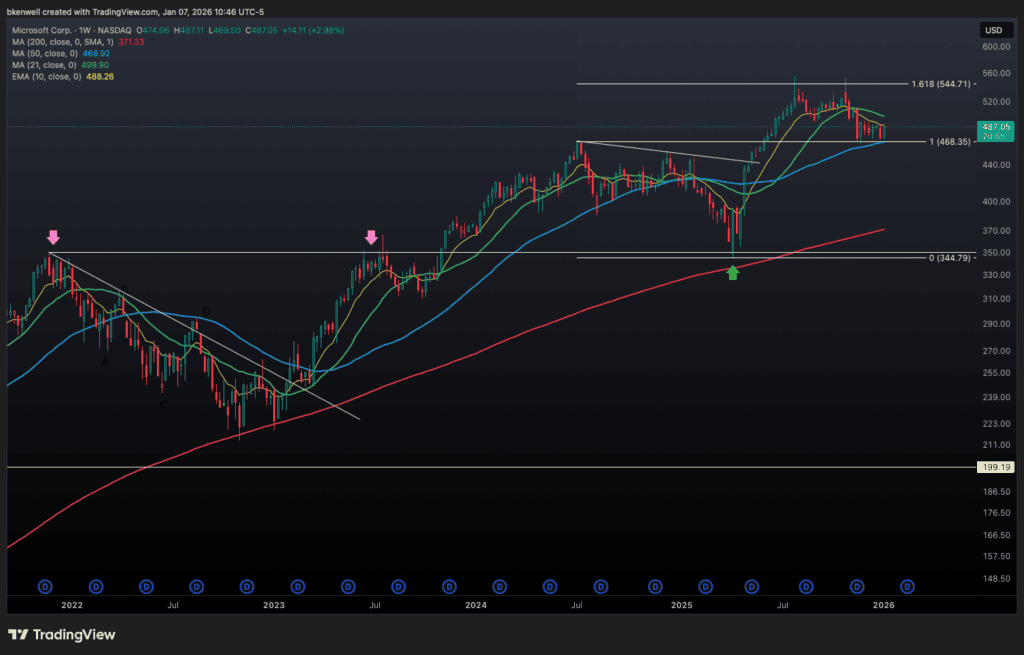

After surging from $350 at the April lows to more than $550 in the summer, Microsoft stock has pulled back. It’s retesting the prior all-time in the $460s and dipping down to the 50-week moving average. In other words, it’s digesting that 61% massive rally. Currently, shares are rangebound between $470 and the low-$490s.

Should MSFT materially break below the 50-week moving average and its prior all-time high, bearish momentum could accelerate. However, if this area holds as support, MSFT could gain more bullish momentum if it’s able to clear $493, and then $500, potentially putting a run toward the $550 to $560 area back in play.

Risks

Microsoft’s primary risks in 2026 center on execution and return on its large-scale AI investments, as heavy infrastructure spending pressures margins and requires sustained monetization to justify valuation. Intensifying competition across AI and cloud services raises the risk of share loss or slower growth. Regulatory scrutiny — particularly around AI governance, cloud dominance, and bundling practices — also looms. Finally, integrating and scaling acquisitions such as Activision Blizzard adds operational complexity and execution risk.

The Bottom Line

Based on historical valuations, Microsoft is not trading at “dirt cheap” levels. However, the stock’s roughly 15% pullback from its highs, alongside solid earnings growth over the past few quarters, has helped push its valuation to the lower end of its range. For some investors, the recent pullback may justify initiating a long position in this industry-dominant name. For others, they may opt to put MSFT on their watchlist and wait for a deeper correction, particularly as Meta, Amazon, and Nvidia all trade at lower forward P/E ratios.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.