Netflix bolsters its streaming library, while it’s a surprisingly busy week of earnings and the Fed is in focus. The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Weekly Outlook

It’s a busy week, with JOLTS on Tuesday and jobless claims on Thursday, offering a fresh look at the labor market as data resumes after the long US government shutdown. In between, the Fed is expected to cut rates by 25 basis points on Wednesday — its third cut this year — and will release its updated economic projections for 2026, which includes their forecast for interest rates, GDP, unemployment, and inflation.

Earnings reports from GameStop, Chewy, Oracle, Adobe, Broadcom, Lululemon, and Costco are also on deck this week.

Netflix Makes a Splash

Netflix shares sank 2.9% on Friday and are now down about 25% from their all-time high in June. However, the big news is Netflix’s acquisition of Warner Bros. Discovery.

The deal unlocks a huge library of content, given that it includes HBO, DC Comics, and Harry Potter — and it will come at a big cost. The $72 billion deal will be funded through a combination of cash and stock, which is sizable even with Netflix’s roughly $425 billion market cap. However, the deal will not include cable networks like CNN or TNT. Lastly, the deal does raise some regulatory concerns, particularly now that President Trump has weighed in on the matter.

Want to receive these insights straight to your inbox?

The Setup — Netflix

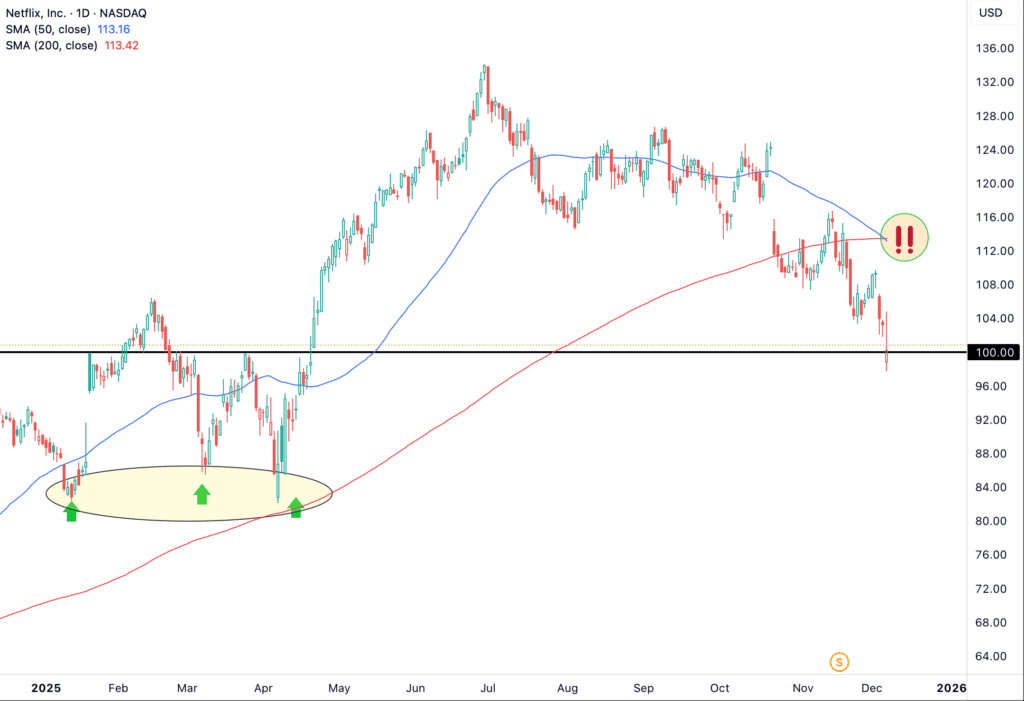

Well before the news of its recent acquisition, Netflix stock had been struggling. Shares have been under pressure since the start of Q3, as NFLX now hovers near $100 — which was the $1,000 level before the stock’s recent 10-for-1 stock split.

Netflix stock is between two key areas on the chart. Should it rally from the $100 level, it faces a potentially stiff area of resistance near $110 to $115, where Netflix’s declining 50-day moving average is currently crossing below its 200-day moving average. However, if shares continue to decline, technical bulls might note that support had come into play in the low- to mid-$80s in the first two quarters of the year.

Options

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Bitcoin rallied to just over $94K last week before pulling back as it went into the weekend. But after a quick bounce, BTC is back near $92K this morning. Bulls are eager to see this rebound continue, potentially putting $100K back in play. If a rally to that magnitude takes hold, it could give a boost to Litecoin, Ethereum, XRP, Solana, and others. Check out the chart for BTC.

Salesforce was sitting at a key support area when it reported earnings last week. Shares climbed about 3.5% on Thursday in response to its results, but then climbed more than 5% in the next session as CRM hit its highest level since late October. Adobe did the same thing with its 5% jump on Friday too. Is this just a short-term bump or is money rotating back into “value” software stocks?

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.