The Daily Breakdown looks at Tesla’s move back to record highs, while zooming in on Cintas’ technical setup ahead of earnings.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

The US government reopened about a month ago, but investors have been starved for economic data as agencies worked through delays in collecting, analyzing, and releasing figures. This week delivers a long-awaited update on jobs, retail sales, and inflation.

Jobs: A Mixed Bag

The October and November jobs reports were released yesterday, with October showing a surprise loss of 105,000 jobs, while November delivered a better-than-expected gain of 64,000. The October drop was likely skewed by shutdown disruptions, though the BLS said the impact was difficult to quantify. Even so, the three-month average turned negative, and the unemployment rate climbed to 4.6% — its highest in four years.

Taken together, the data show a labor market that is cooling, but not collapsing.

Retail Sales: Good, Not Great

October’s retail sales data also offered a mixed picture. Headline sales missed expectations and the prior month was revised lower, but core retail sales, which strips out volatile items like auto fuel, beat economists’ expectations, as did control group sales, which are used to calculate GDP. The data suggest that consumers are walking, not running when it comes to economic activity, but are nonetheless moving forward.

Key Takeaway

The labor market is losing momentum and consumer spending is moderating, but neither has broken. For investors — and the Fed — this supports the case for easing policy in 2026, while signaling that economic softness must be monitored closely.

Want to receive these insights straight to your inbox?

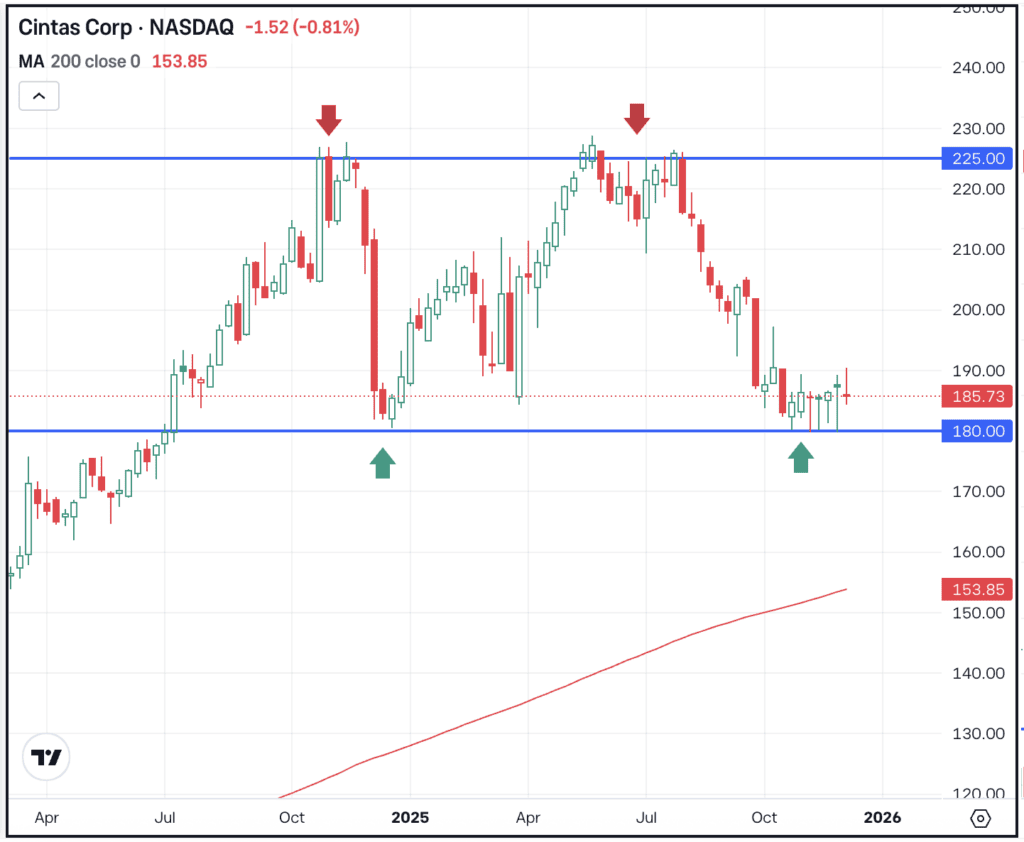

The Setup — Cintas

Cintas is due to report earnings on Thursday morning. While this company has been a strong long-term performer, its valuation has come into question this year and the stock has struggled for traction. Shares have produced gains in 16 straight years — something we noted in our Deep Dive of CTAS earlier this year — but are up just 2.7% so far in 2025.

Cintas has been rangebound for the past year, trading between $180 on the downside and $225 on the upside. This range trade has helped consolidate the stock’s big gains and helped to lower the valuation as profits have continued higher. If support continues to hold near $180, bulls might look for an eventual recovery back over $200 and toward the top of the range. However, if support breaks, it could open the door to lower prices.

Options

As of December 16th, the options with the highest open interest for CTAS stock — meaning the contracts with the largest open positions in the options market — were the June 2026 $230 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Micron is gearing up to report its fiscal first quarter results after the close, with analysts expecting earnings of $3.82 a share on revenue of $12.8 billion. The company has beaten revenue estimates in 13 of the past 17 quarters, although investors will likely be more focused on guidance and management’s commentary around AI. The stock has had an outstanding year, up 176% so far in 2025. Check out the chart for Micron.

Tesla stock has been rolling too and just notched a fresh record high on Tuesday, surpassing its prior peak from December 2024. While shares are up a more modest 21% so far in 2025, shares have more than doubled from the April lows, while having Elon Musk back in a larger capacity has allowed shareholders to refocus on the company’s longer term potential. Dig into the fundamentals for TSLA.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.