The Dow broke above the 50,000 level for the first time, while tech and bitcoin surged on Friday. The Daily Breakdown dives into the action.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Because of the brief government shutdown earlier this month, last week’s jobs report was pushed to Wednesday. It’s the key data point on this week’s calendar, alongside Tuesday’s retail sales report and Friday’s CPI inflation report.

Earnings

Earnings season continues with several notable reports. Spotify, Coca-Cola, Ferrari, Ford, and Lyft report Tuesday. Shopify, McDonald’s, and Cisco Systems report Wednesday. Airbnb, Coinbase, and DraftKings report Thursday, with Carnival Cruise rounding out the week on Friday.

Big Rebound

After volatility spiked, markets staged a sharp rebound on Friday. The Nasdaq 100 gained 2.1%, while the Russell 2000 — the best-performing major US index so far this year — surged 3.6%. Crypto also jumped: Bitcoin rallied more than 12% toward $70K, Ethereum climbed about 13%, and XRP rose more than 20%.

Want to receive these insights straight to your inbox?

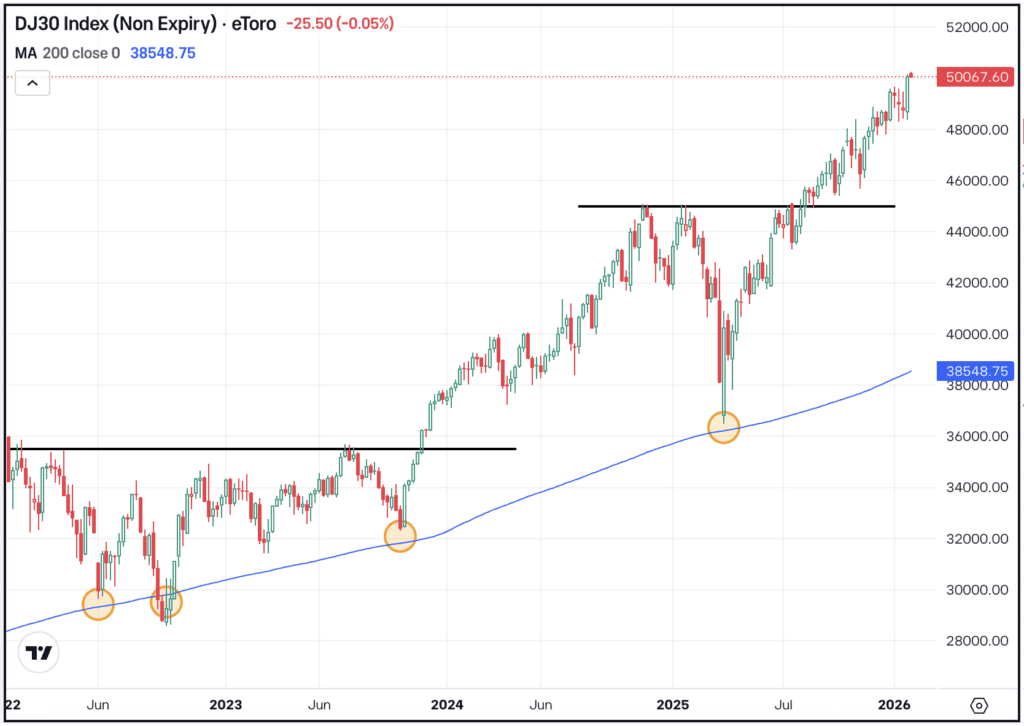

Chart of the Day — Dow 30

Volatility is wreaking havoc for software stocks, tech, crypto, and precious metals, but other indices and sectors are doing just fine. For instance, energy, staples, industrials, and materials are breaking out, while the Dow Jones Industrial Average hit new all-time highs on Friday and topped the 50K level for the first time.

The index’s most popular ETF by trading volume and AUM is the DIA ETF, which is up more than 4% so far this year. The DIA also supports options trading.

Options

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Hims & Hers said it will stop offering its copycat Wegovy weight-loss pill after Novo Nordisk and the FDA threatened legal action. The move follows heightened scrutiny over compounded drugs and comes as Hims prepared to run a Super Bowl ad focused on America’s “health gap.” Shares of Novo Nordisk are up about 5% this morning. Stay on top of the news for HIMS.

AMZN

Despite Friday’s broader rally, Amazon slid about 5.5% as investors parsed its quarterly results. AWS was solid and overall revenue beat expectations, but EPS of $1.95 narrowly missed the $1.97 consensus. Management’s $200 billion 2026 capex outlook also weighed on sentiment. Check out the charts for AMZN.

NVDA

Despite several Magnificent 7 names issuing far higher-than-expected capex guidance, Nvidia has struggled to break higher. That changed Friday, when shares surged nearly 8%. NVDA is still roughly flat year-to-date (down 0.6%), but bulls are hoping the move marks a momentum inflection. Here’s a closer look at the fundamentals. Dig into the fundamentals for NVDA.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.