TRADE THE FUTURE, TODAY WITH FUTURES

Discover a new way to trade with Spot-Quoted Futures by CME Group

Why trade futures on eToro?

Whether you’re experienced with trading futures or just starting out, eToro’s easy-to-use, intuitive platform is the perfect choice

Execute multiple contracts in one transaction. Manage all of your trades from one multi-asset portfolio, without multiple logins.

Trade futures most hours of the day, 5 days a week. Place orders for immediate execution whenever exchanges are open.

Access free educational resources, advanced charts, real-time data and 24/5 customer service.

Understanding the differences across derivative types

See how CFDs, SQFs and Futures on eToro compare across pricing, leverage, expiry and more.

| Feature | CFDs * | SQFs | Micro Futures |

|---|---|---|---|

| Definition | A contract with eToro to trade on price movements of an asset without owning it | Standardised, exchange-traded contracts to buy or sell an asset at a long-dated future for the current spot price | Standardised, exchange-traded contracts to buy or sell an asset at a future date for a fixed price |

| Typically used for | Short-term flexibility, smaller sizes | Short to medium-term exposure with a friendlier futures experience | Short-term exposure |

| Traded on | OTC traded | Traded on regulated exchange authorities (e.g., CME, NFA) | Traded on a regulated exchange (e.g., CME, NFA) |

| Commission | No commission on most assets; cost is built into the spread. | Flat fee per contract. View on fees page | Flat fee per contract. View on fees page |

| Expiry | No expiry unless explicitly specified | Yearly expiry | Monthly or quarterly expiry dates |

| Overnight Fees | Daily overnight fee | Transparent daily financing adjustment | No overnight fees apply |

| Minimum Margin | Varies by asset | Starts from approximately $200 | Mostly higher due to larger contract sizes |

| Leverage (Retail) | Up to 1:30 (Per ESMA rules) | Set by CME margin (Approx. 1:10 to 1:20 leverage) | Set by CME margin (approx. 1:10 to 1:20 leverage) |

| Contract Size | Flexible sizing – trade fractional amounts | Fixed size, standardiszed per SQF contract specification | Fixed contract sizes |

| Contract Roll | No rollover required; open-ended positions | Long-dated expiry reduces need for frequent rolls | Requires roll if holding beyond expiry (manual or automated) |

*CFDs are not available for residents of Spain and Belgium

All three products involve leverage and carry a high risk of loss. Leveraged trading is not suitable for all investors. You may lose more than your initial deposit, particularly with Futures and SQFs. Ensure you fully understand the risks and consider whether the product suits your investment goals and risk profile.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 46% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to assumetake the high risk of losing your money.

This information is provided for educational purposes only and does not constitute investment advice or a recommendation to trade.

Trade futures responsibly

Futures trading can be rewarding, but it also carries risks. Understanding the market is key — trade responsibly and stay informed.

- Read our guide to learn more about futures trading.

- Start small if you’re a beginner.

- Setting a stop-loss order is required to manage risk.

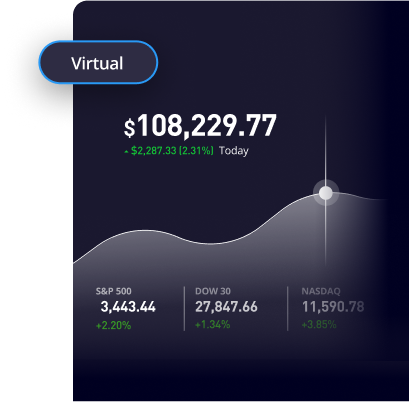

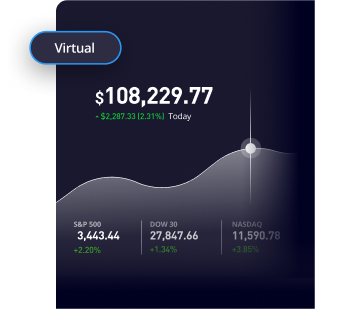

- Use eToro’s demo account to practise your strategy.

- Understand that trading with leverage amplifies both gains and losses.

- Be aware that prices can change rapidly, especially near expiry.

- Ensure that your account has sufficient funds to avoid a margin call, which can result in the forced closure of trades.

- Futures contracts are listed on the Chicago Mercantile Exchange Inc. (CME). Be sure to review CME’s terms and conditions here.

- Read the Futures risk disclosures to understand the risks.

FAQ

- What are futures?

-

Futures are exchange-traded contracts where two parties agree to buy or sell an asset, such as oil, gold or a stock index, at a predetermined price on a future date. While some futures involve physical delivery, all contracts on eToro are cash-settled. The cost of carry (interest, dividends, etc.) is already priced into standard futures.

- What is futures trading?

-

Futures trading allows participants to buy or sell contracts on popular assets at a predetermined price on a future date. If you think the price of the asset will go up, you may buy a futures contract; if you think it will go down, you can sell one. Your potential profit or loss is the difference between the buy and the sell price, minus any trading costs.

Trading on a regulated exchange means that, when a futures contract is bought or sold, the exchange becomes the buyer to every seller and the seller to every buyer. This creates a transparent marketplace. - What happens at expiry?

-

Futures trading involves contracts with a set expiry date, at which time all trades must be settled. Futures trades can be manually closed up to eToro’s last trading day, which may occur on or before the expiry date, depending on the settlement type.

- For contracts with cash settlement, users can hold the positions until the expiry date, at which point eToro will automatically close the trades with the official exchange settlement rate.

- Any remaining open cash-settled client positions held until expiry will not close immediately. Instead positions will be closed and locked until the final settlement price is confirmed by the exchange. This process can take up to one trading day after the expiry date. Once the settlement price becomes available, the positions will be manually processed and closed by our Back Office. Terms and Conditions apply.

- For contracts with physical settlement, all trades will be closed on eToro’s last trading day, which is also visible on the trade screen and typically one day before the “First Notice Day”, which is defined by the exchange. eToro does not support holding physical settlement contracts until the settlement date, as users will not receive the underlying assets physically.

- Any remaining open positions will be automatically liquidated on this early expiry date. Liquidation will occur on that trading date, typically between 7:00 and 13:00 ET.

- eToro will liquidate the open position by sending offsetting trades for execution in the market on behalf of the client.

Please note: eToro may charge fees on positions left open for expiry. eToro reserves the right to stop trading on any future that is traded around or below a price of $1, due to negative price risk considerations.

- For contracts with cash settlement, users can hold the positions until the expiry date, at which point eToro will automatically close the trades with the official exchange settlement rate.

- How are futures trading commissions calculated on eToro?

-

eToro displays a single all-inclusive commission per contract. This flat fee covers all required third-party costs, including:

- Exchange execution fees (e.g. CME)

- Clearing fees

- Regulatory fees (e.g. NFA or SEC, if applicable)

- Routing and infrastructure costs

From this total, $0.75 per contract is retained by eToro as a service fee. The rest is used to cover external costs.

- What are Spot-Quoted Futures (SQFs)?

-

SQFs are a new kind of exchange-traded futures contract from CME Group, designed for active traders. Unlike micro futures, SQFs are traded at the current market or spot price rather than the futures price and don’t require monthly or quarterly rollovers.

- How do Spot-Quoted Futures (SQFs) work?

-

SQFs are exchange-traded futures that follow the real-time spot price of the underlying asset. Instead of being priced based on forward curves, they include a daily adjustment that keeps the contract closely aligned with the current market or spot price.

Same-day SQF trade (Example)

Let’s say a trader buys and sells a Spot-Quoted Futures (SQF) contract on the S&P 500 on the same day.

- Buy: 1 contract at 5,840.00 in the morning

- Sell: 1 contract at 5,855.00 later that day

- Daily adjustment (ADJ): –9.00 index points (applied to both buy and sell)

Final calculation:

- Buy entry adjusted to: 5,840.00 – 9.00 = 5,831.00

- Sell exit adjusted to: 5,855.00 – 9.00 = 5,846.00

- Profit: 5,846.00 – 5,831.00 = 15 points = $15 profit

Result: $15 profit from a same-day trade, after accounting for the daily adjustment.

SQF trade held overnight (Example)

Now let’s say a trader opens a position one day and closes it the next.

- Buy: 1 contract at 5,840.00 on Day 1

- Sell: 1 contract at 5,855.00 on Day 2

- ADJ on Day 1: –9.00

- ADJ on Day 2: –9.50

Final calculation:

- Buy entry adjusted to: 5,840.00 – 9.00 = 5,831.00

- Sell exit adjusted to: 5,855.00 – 9.50 = 5,845.50

- Profit: 5,845.50 – 5,831.00 = 14.5 points = $14.50 profit

Result: $14.50 profit after holding the trade overnight and applying two daily adjustments.

The examples above are provided for illustrative purposes and do not consider the eToro Holding Rate. This does not constitute investment advice or a recommendation. Other fees apply.

- Why did CME Group create Spot-Quoted Futures?

-

SQFs were designed to offer a more accessible futures experience for modern, self-directed traders. They feature smaller contract sizes, longer-dated expiries (up to one year) and spot-based pricing—eliminating the need to roll contracts monthly.

- How do SQFs differ from micro futures contracts?

-

Micro futures are priced based on forward curves and often require monthly rollovers. SQFs track the spot market more closely and apply a daily adjustment instead of building costs into the price upfront. They also use smaller contract sizes and have a one-year expiry, making them easier to manage.

- How is the daily adjustment (overnight fee/refund) different from rollover fees?

-

Rollover fees apply when a contract approaches expiry and is manually or automatically extended. SQFs don’t require monthly rollovers. Instead a daily adjustment (ADJ) is applied automatically, reflecting market-based factors like interest, dividends or funding costs, and appears as a transparent overnight fee.

- What factors influence the daily adjustment amount (ADJ)?

-

The daily adjustment (overnight fee/refund) reflects the cumulative effect of factors like interest rates, dividends and funding costs. It’s calculated once per day and may be either positive or negative, depending on market conditions and your position.

- What happens when an SQF expires?

-

SQFs typically expire once a year. At expiry, any open position will be settled at the final settlement price of the contract, just like standard futures. You can close your position at any time before expiry.

- Do I need a special account to trade SQFs?

-

No special setup is required. If you have access to futures trading on eToro, you can trade SQFs just like any other listed futures product.

- Can I close an SQF position before it expires?

-

Yes. You can open and close SQF positions at any time during market hours, just like with other futures contracts. You don’t need to hold them until expiry.

- Are SQFs suitable for short-term trading?

-

Yes. Although SQFs have a one-year expiry, their spot-based pricing and flexibility make them suitable for both short and medium-term strategies with high risk tolerance.

- Can I partially close positions?

-

If you hold positions with multiple contracts, you can close one or more contracts that are part of your position while keeping other contracts in the position open. This gives you flexibility to adjust your exposure based on market conditions or your trading strategy. Please note that the contracts themselves cannot be partially closed.

- Is CopyTrader supported for futures trading?

-

At this time, CopyTrader does not support futures trading.