Semiconductor stocks are in focus after earnings from Taiwan Semi. The Daily Breakdown’s chart of the day is SanDisk (SNDK).

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Bulls are hoping that Taiwan Semiconductor can help stabilize the slide in tech stocks, which led Wall Street’s retreat on Wednesday. The Nasdaq 100 slid 1.1% — more than double the S&P 500’s 0.5% decline — while the Dow was nearly flat. Meanwhile, the Russell 2000 climbed 0.7%, as small-cap outperformance remains a key theme to start 2026.

Taiwan Semi’s Spark

Most of this week’s earnings reports have been dominated by the banks, but with a $1.4 trillion market cap, Taiwan Semi stands out as well. The firm delivered a top- and bottom-line beat, with earnings of $3.14 per share topping estimates of $2.79 per share, while revenue of $33.7 billion exceeded expectations of $33.3 billion. Management also provided above-consensus guidance for revenue and capex spending, while margins came in well ahead of estimates.

The news is lifting shares of TSM, which are trading at record highs this morning. ASML, Applied Materials, and Lam Research are also jumping in response, while the Nasdaq 100 is up nearly 1% in premarket trading.

Will this be enough to spark a broader tech rebound? While the sector is up 0.5% so far this year, it is the third-worst-performing sector in the S&P 500.

Want to receive these insights straight to your inbox?

Chart of the Day — SanDisk

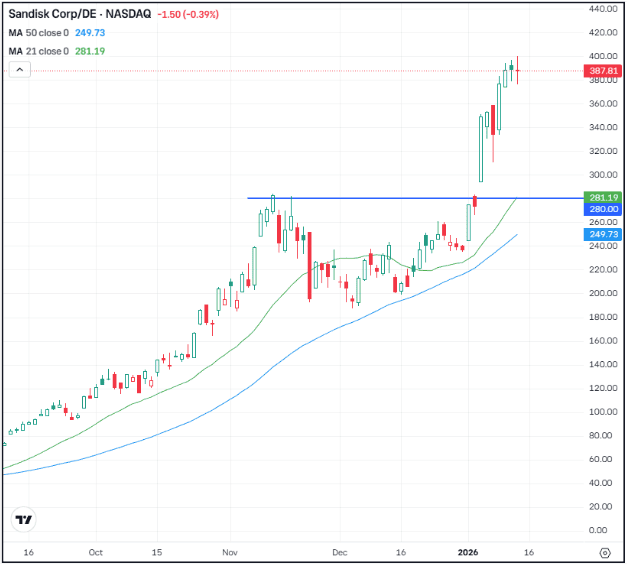

SanDisk was added to the S&P 500 in November — and what a run it has been on. So far this year, shares are up more than 60%, as SNDK continues to bombard higher.

After a powerful rally in Q4 sent SanDisk to new heights in mid-November, shares retreated before finding support near $200. Ultimately, the stock was able to break out to new highs this year, fueling a rapid run toward $400. As volatility increases in this name, so too does the risk — but so far, bulls have been benefiting from the price action.

Options

As of January 14th, the options with the highest open interest for SNDK stock — meaning the contracts with the largest open positions in the options market — were the $250 puts.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Goldman Sachs stock is down slightly in pre-market trading after the firm beat on earnings, but missed on revenue expectations (which was impacted by the sale of its Apple Card portfolio to JPMorgan). The banking giant delivered a record quarter of equities-trading revenue, hitting $4.31 billion — a new Wall Street record. Goldman Sachs also raised its dividend to $4.50 a share, up from $4 a share. Dig into the fundamentals for GS.

The $94K level had been acting as resistance for Bitcoin for several months now, but the world’s largest cryptocurrency was able to break out over this mark on Wednesday. Now bulls are hoping that BTC can remain above this level, potentially building more bullish momentum in the process. Check out the chart of BTC — and remember, options trading is supported on IBIT, the largest Bitcoin ETF by AUM. For those looking to learn more about options, visit the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.