The Daily Breakdown digs into Morpho and Chiliz, then dives into the charts for Bitcoin Cash and looks at market movers Spotify and Ferrari.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Crypto Corner

We’re continuing our talk about the ins and outs of the crypto market, helping investors become more familiar with the 110+ cryptoassets offered by eToro.

Morpho (MORPHO): Currently trading near $1.10 with a market cap of ~$425 million

Morpho is a decentralized lending protocol launched in 2022 that enhances platforms like Aave and Compound by adding a peer-to-peer matching layer to optimize interest rates for lenders and borrowers. Built on the Ethereum Virtual Machine (EVM), Morpho supports overcollateralized lending and yield-generating vaults managed by independent risk curators. The MORPHO token is used for governance, enabling holders to vote on upgrades and protocol direction. Morpho focuses on efficiency, security, and user-driven optimization rather than profit-sharing or centralized control.

Chiliz (CHZ): Currently trading near $0.04 with a market cap of ~$400 million

Chiliz powers tokenized fan engagement for sports and entertainment, primarily through Socios.com and the Chiliz Chain, an EVM-compatible Layer 1. Fans use CHZ to buy team fan tokens, vote on certain club decisions, and unlock perks like merchandise access, ticket promos, and in-app rewards. Governance on the chain is validator-based, with delegators participating through staking and voting. CHZ is designed around access and participation — not ownership, dividends, or profit-sharing — with value tied to platform usage and partner adoption across sports, media, and e-sports.

Want to receive these insights straight to your inbox?

The Setup — Bitcoin Cash

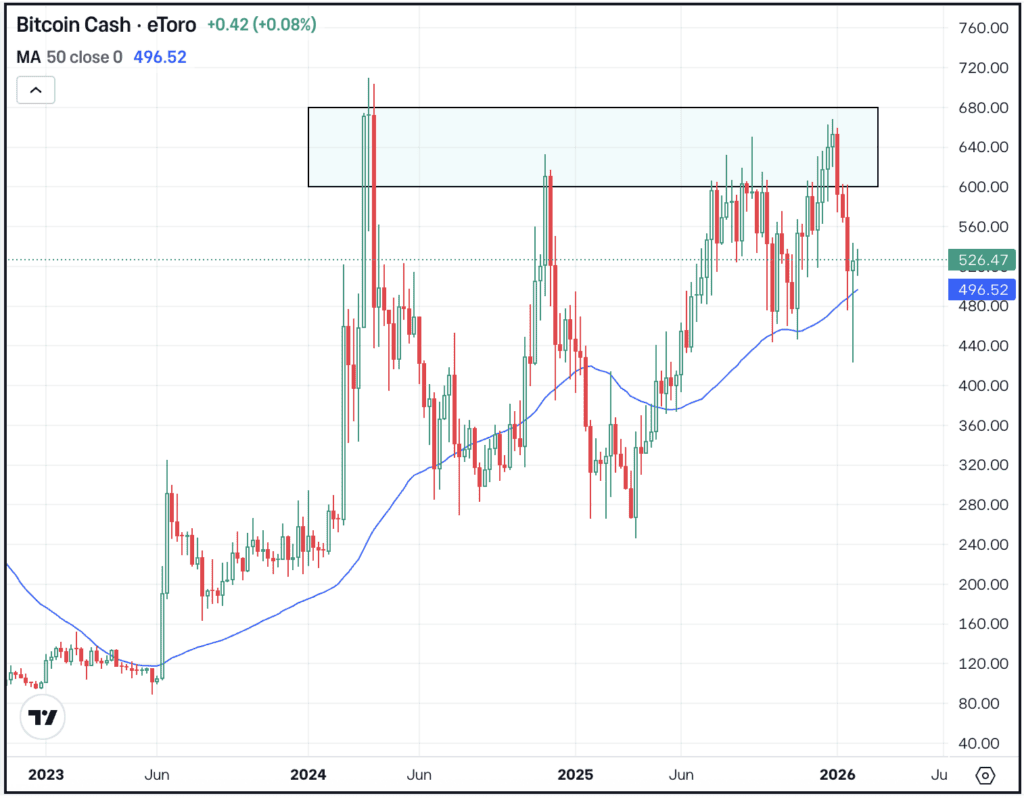

Bitcoin Cash may be in the midst of a ~20% drawdown from its recent highs, but it’s holding up much better than Bitcoin, Ethereum, Solana, and many other top crypto holdings. Last time we looked at BCH, it was hitting 52-week highs, but was running into the resistance zone outlined below.

Currently, support is materializing in the $440 range and near the 50-week moving average. If the selling pressure continues and this area fails, bearish momentum may increase. If support holds though, bulls might look for a further bounce to the upside.

What Wall Street’s Watching

Shares of Spotify are rallying this morning, up almost 10% after the firm beat on earnings and revenue expectations. Further, monthly active users (MAUs) reached 751 million, up 11% year over year and beating analyst expectations of ~745 million. For a refresher on Spotify and its valuation, check out our Deep Dive.

RACE

Ferrari stock is also racing higher by about 10% this morning as fourth-quarter earnings and revenue topped expectations despite deliveries declining ~5% year over year. More notably though, management’s 2026 outlook impressed investors. For a refresher on Ferrari, check out our Deep Dive.

KO

After surging to record highs, Coca-Cola is pulling back this morning. EPS of 58 cents beat estimates of 56 cents, while revenue of $11.82 billion missed expectations of $12.03 billion. Coming into the session, shares were up about 13% this year. Dig into the fundamentals for KO.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.