The Daily Breakdown noted the breakout in ASML earlier this week and decided to do a deep dive into its fundamentals. Here’s what we found.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Thursday’s TLDR

- Business seems to have stabilized

- But trade policy remains a risk

- GME, ORCL in focus this morning

Deep Dive

Earlier this week, we looked at the potential breakout taking place in ASML. Now I want to take a deeper dive into the fundamentals.

ASML is a Dutch company that designs and manufactures advanced photolithography machines used in the semiconductor industry, particularly extreme ultraviolet (EUV) lithography systems that are critical for producing cutting-edge chips at nanoscale precision.

In plain English: ASML builds the machines that make the chips.

The company’s largest customers include Taiwan Semi, Intel, Samsung, and Micron, among others.

In mid-2024, shares of ASML topped $1,100 a share. By November though, the stock was trading in the mid-$600s, a decline of about 40%. The problem? Sentiment was fading quickly as investors worried about order demand, particularly due to restrictions on China.

Although there have been some headwinds — management was forced to reduce its outlook last year — there seems to have been a stabilization in its business.

The Fundamentals

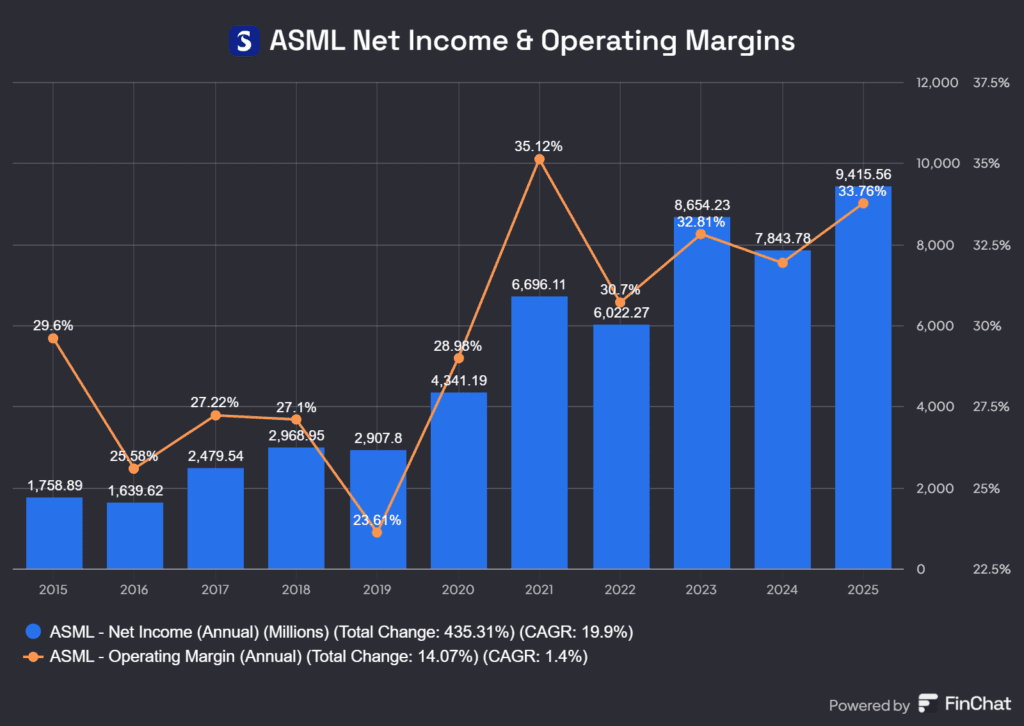

After just 3% revenue growth and a ~2% earnings decline in 2024, analysts expect 2025 to be much different, with estimates calling for 15% revenue growth and 23% earnings growth. Further, they expect double-digit earnings growth in 2026 and 2027.

The Magnificent 7 companies recently reiterated their big spending plans (with a lot of investment going into AI infrastructure). Combined with the strong earnings reports from Nvidia and Taiwan Semi, we know that demand for AI infrastructure remains strong — and that’s good for ASML.

That said, the current trade environment still makes for a bumpy path forward. As my colleague Jean-Paul van Oudheusden wrote in April after ASML’s most recent earnings report:

“For Q2 2025, ASML expects slightly lower revenue of between €7.2 and €7.7 billion. Nevertheless, [CEO Christophe] Fouquet and [CFO Roger] Dassen reiterated their full-year revenue target of €30 to €35 billion. The upper end of that range could be achieved if existing orders — many driven by AI-related demand — are delivered on schedule. Uncertainty surrounding the import duties could, however, cause delays.”

Want to receive these insights straight to your inbox?

ASML — Valuation

ASML is a backbone component to the semiconductor space. If business has stabilized and the company can return to growth, then investors may view the stock as undervalued at current levels.

On the flip side, trade-policy issues or weaker-than-expected demand can continue to weigh on sentiment for the stock. Further, it could hurt ASML’s financial results, which would make the valuation more expensive, prompting a potential decline in the stock price.

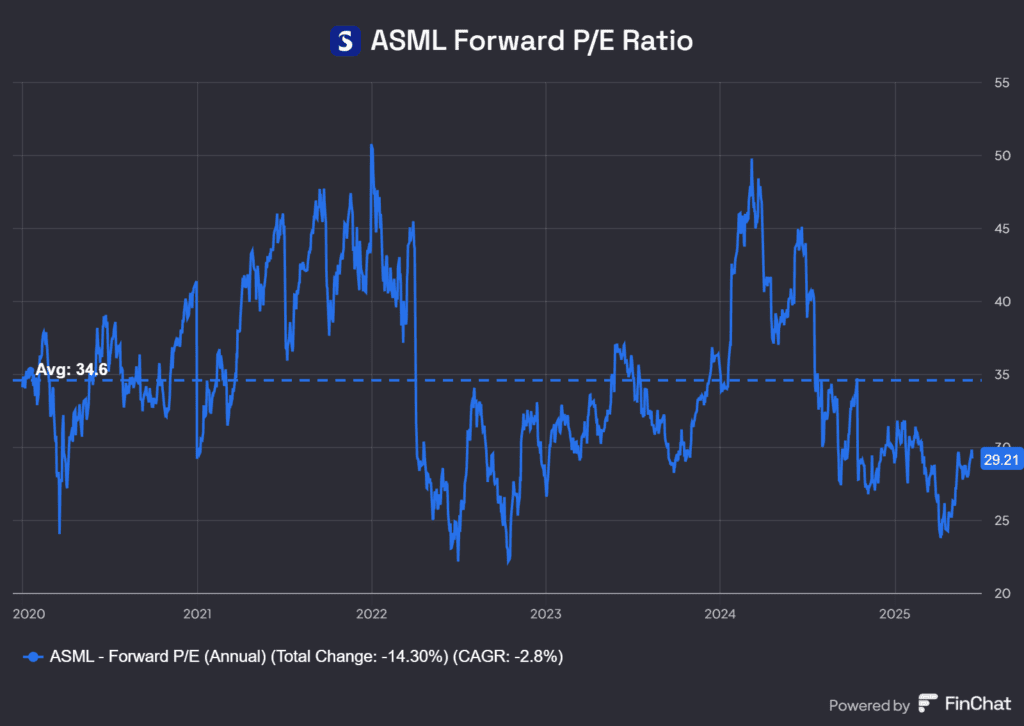

Above is a look at the stock’s forward price-to-earnings ratio (more information about valuation can be found in our recent Fundamental Analysis Boot Camp).

On the chart above, we can see that dips below 25 times forward earnings tend to mark a trough, while pops toward 45 times earnings has been tough to sustain. Relatively speaking then, shares of ASML are historically cheap at around 25x earnings and expensive at 45x earnings.

With the recent momentum in its stock price, the valuation has rebounded. Some bulls may still find 29.2x earnings close enough to the recent trough to consider it attractively valued. Others may prefer to wait for a dip back to lower prices (knowing that the risk here is that ASML stock doesn’t fall that far). Lastly, bears may view ASML as too expensive or too uncertain to invest in right now.

For what it’s worth, the consensus price target on ASML is about $900, implying 15% upside. Still, investors must do what they feel comfortable with and determine if ASML is a stock that fits well in their portfolio.

***

On an unrelated side note: eToro just added four new cryptocurrencies available to trade, including: Quant, Storj, Ethereum Name Service, and SushiSwap. Check out the crypto discover page to see more.

What Wall Street Is Watching

SPY

The S&P 500 and the SPY ETF continued to inch back toward record highs yesterday, coming within 1.4% of its February record. Another tame inflation report gave investors a confidence boost on Wednesday, as tariff impacts have yet to send a jolt through consumer pricing. However, stocks came under pressure in afternoon trading and are dipping again this morning on worries over global trade policy. Check out the chart for SPY.

Shares of Oracle are within a stone’s throw of all-time highs as shares are rallying almost 10% in pre-market trading. Better-than-expected earnings and revenue results combined with an upbeat outlook due to the company’s momentum in cloud and AI services. Dig further into the company’s recent news.

GameStop stock is tumbling this morning, down about 15% in pre-market trading after the company announced a convertible debt offering. While some view this as a way to boost its cash reserves and invest in Bitcoin, others are worried about the dilutive impact to the stock.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.