Nike stock has been crushed from its record highs. Is it a value trap or in the bargain bin? The Daily Breakdown digs in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Friday’s TLDR

- Nike is in a turnaround

- But the stock is down hard

- The valuation is mixed

What’s Happening?

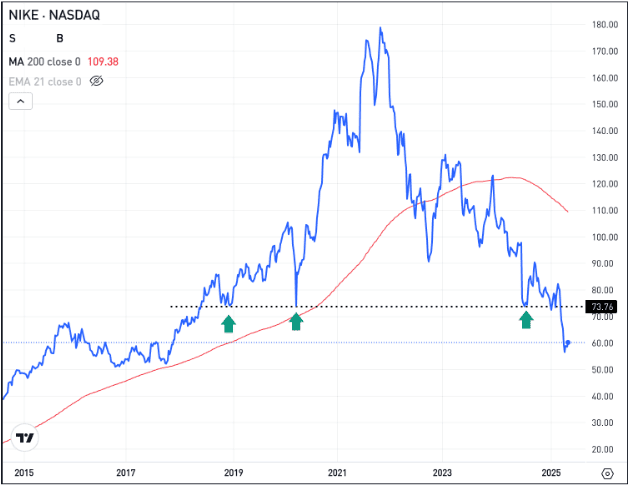

Nike remains a dominant player in global sportswear, leveraging its iconic brand, innovative products, and strong leadership. Despite its stature, the stock has struggled — down 22% this year and 67% off its November 2021 highs. The company is navigating inventory issues, shifting consumer tastes, and a poorly executed pivot to direct-to-consumer sales. Wholesale partners turned to competitors like Adidas and On, putting further pressure on Nike’s sales.

In late 2024, Nike brought in veteran Elliott Hill as CEO, while investor Bill Ackman took a sizable stake via Pershing Square. Yet, while markets have rebounded from the 2022 bear market, Nike has not. The question now becomes: Is this a value trap or a turnaround story in progress?

Turnarounds Take Time

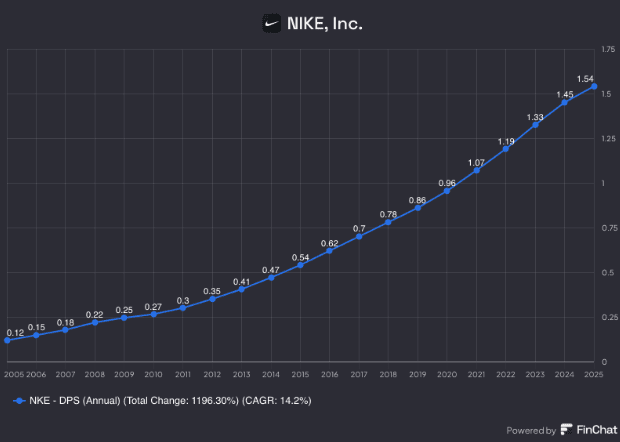

Nike still presents a compelling long-term opportunity, thanks to its global brand, strong margins, and history of dividend growth (now yielding about 2.75%). Hill is refocusing on core performance categories and rebuilding wholesale relationships. However, investors remain cautious about how soon these changes will drive growth.

Nike is in the final quarter of its fiscal 2025 (which ends in May), a year where revenue and earnings are expected to fall by 11% and 42%, respectively. Fiscal 2026 (which starts in June) is projected to be about flat, with a return to growth in 2027. But markets are forward-looking — if Nike signals an earlier rebound, shares could react positively. If not, pressure may persist.

You can view Nike’s financial picture right here.

Pros and Cons

Nike’s strengths are clear: refreshed leadership, a strong brand, a history of increased dividend payments, and signs it’s moving past its rough patch. With the stock still down over 60% from its highs, value-oriented investors see potential.

But risks remain. Nike is vulnerable to economic cycles, currency swings, and supply chain disruptions. Competition is intense, and growth in China — once a major driver — has slowed. Additionally, the ongoing trade war adds geopolitical uncertainty.

Want to receive these insights straight to your inbox?

The Setup — NKE

On several valuation metrics, such as cash flow, Nike has gotten cheaper on a relative basis. However, because profits have been pressured, its earnings-based valuation hasn’t become as cheap as some value hunters might have hoped. If profits begin to rebound more quickly though, this could help its valuation.

All that said, the average analyst price target on Nike stock is roughly $79, implying about 34% upside from current levels.

Should Nike stock embark on a solid rally, the mid-$70s may be on investors’ radar. That was a key level of prior support. For a sustained, long-term move to the upside, NKE will have to clear this level.

A sustained rally in Nike stock is possible. However, it will likely require further traction in the company’s turnaround efforts and renewed confidence among its investor base. Otherwise, this stock may continue to languish.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.