Mega-cap tech continues to spend heavily on AI. Likewise, AI continues to gain in popularity. The Daily Breakdown digs into the trends.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Weekly Outlook

And just like that, we’re in the last week of January already! Markets will look to go out in style with a fully-loaded slate of events to watch this week.

Earnings

The earnings pace is really picking up now, particularly with Big Tech on the board. Tesla, Microsoft, and Meta will report on Wednesday evening, while Apple will report on Thursday.

We’ll also hear from Boeing, General Motors, and UPS on Tuesday, followed by ASML, AT&T, and Starbucks on Wednesday.

On Thursday, companies like Visa, MasterCard, Lockheed Martin, SanDisk, and Western Digital will report, followed by SoFi, American Express, Verizon, Exxon Mobil and Chevron on Friday.

The Fed

We typically receive the PCE inflation report this week, but the schedule remains somewhat disrupted due to the government shutdown, and the data was released last week. This week, consumer confidence stands out as a key report on Tuesday, but it’s the Fed’s interest rate decision and press conference that loom largest — due up on Wednesday at 2 pm ET.

Want to receive these insights straight to your inbox?

Chart of the Day: Mag 7 Spending & AI

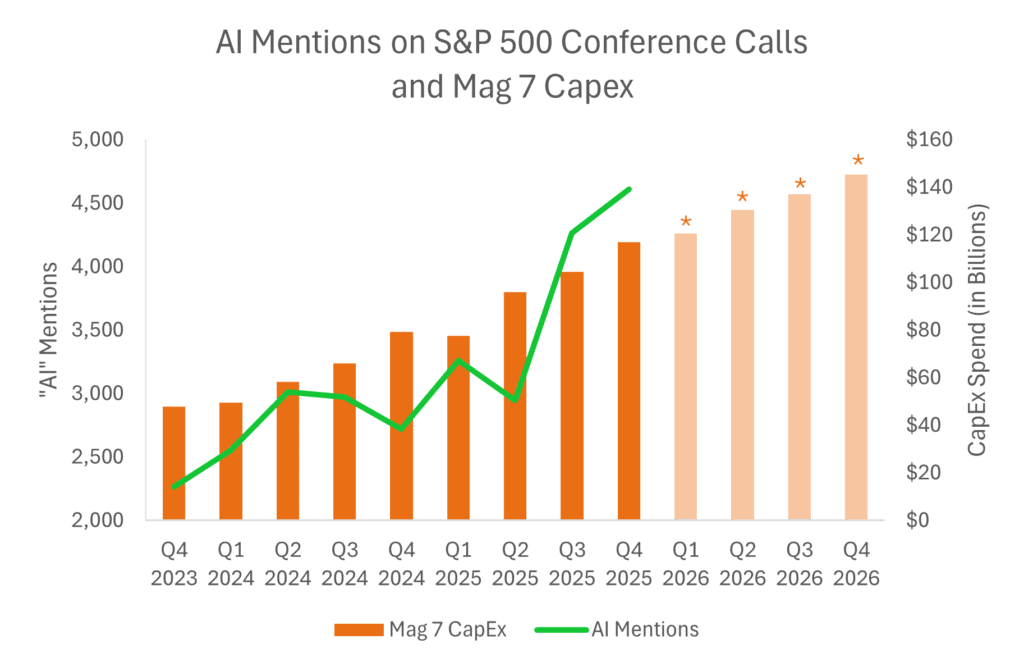

With big tech in focus this week, I wanted to take a closer look at AI and the Magnificent 7’s spending spree.

In the chart above, Magnificent 7 quarterly capex spending (capital expenditures) is shown in orange, with estimates extending through 2026, alongside the number of times “AI” was mentioned on S&P 500 conference calls.

As shown, discussions around AI have — unsurprisingly — accelerated over the past few quarters. This momentum reflects companies increasingly embedding AI into their operations, a trend many bulls expect to continue in 2026 and beyond.

As a reminder, the Magnificent 7 includes: Apple, Amazon, Alphabet, Meta, Microsoft, Nvidia, and Tesla. For those looking at the S&P 500, the VOO ETF is the most popular by AUM, while the SPY ETF has the largest interest by trading volume (which makes it the more common choice for options traders).

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.