The Daily Breakdown takes a closer look at the potential for the US government shutdown to come to an end.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Markets don’t like uncertainty, and unfortunately, there’s been plenty of it lately. Everyone has likely seen the headlines and videos of the airport chaos here in the US, which is a result of the longest government shutdown in US history. But there’s also growing uncertainty about the legal ruling for tariffs, the Fed’s interest rate policy, and the labor market.

Investors are hoping the end is near for the government shutdown. While the Senate appears to have enough votes for an agreement, it still has to get through the House and the President. So while it’s not a done deal, it’s certainly a step in the right direction — and markets are taking notice.

Bitcoin is up 7% from Friday’s low, while Ethereum is up ~13%. In pre-market trading, the Nasdaq 100 is up ~1.5% and the S&P 500 is ~1%.

Earnings Take a (Mild) Break

Because the government is still shut down, there remains a notable lack of economic reports to focus on this week. And while next week is a big one for earnings — including retailers and Nvidia — this week is a little quieter on that front.

Still, we’ll hear from companies like Rocket Lab, Rigetti Computing, and Occidental Petroleum on Monday, while Circle, On Holdings, and Cisco will report on Wednesday. Disney, JD.com, and Applied Materials will round out the week, among others.

Want to receive these insights straight to your inbox?

The Setup — The Trade Desk

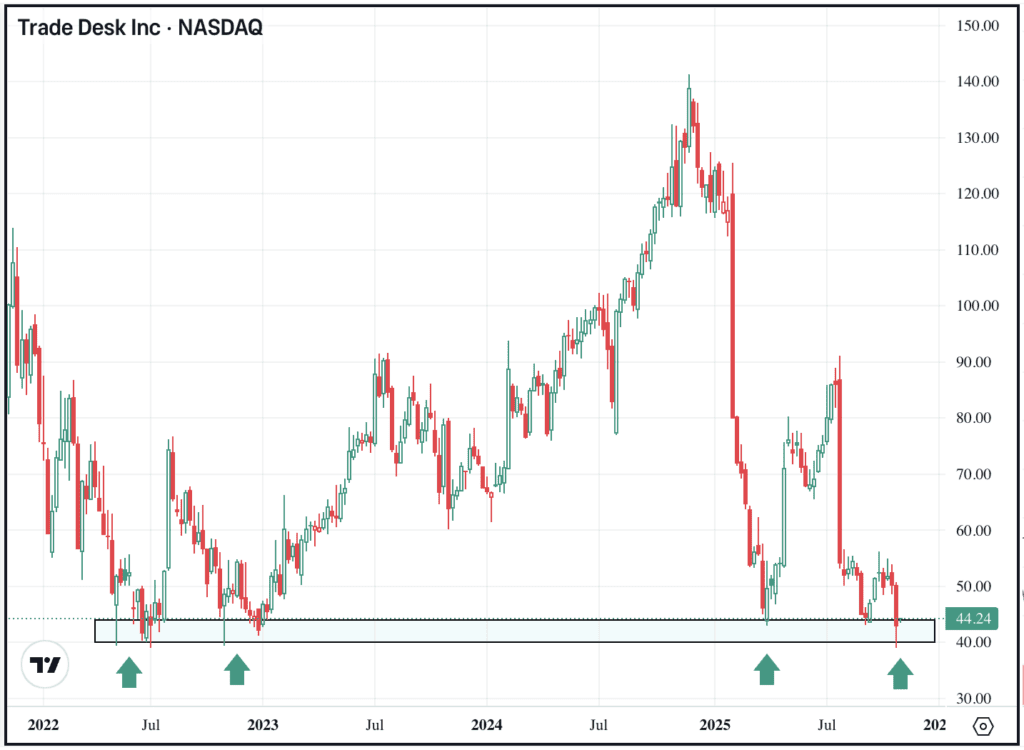

A year ago, The Trade Desk was riding a wave of momentum to new record highs. Unfortunately, 2025 has been a different story, with shares plunging from $140 to the low-$40s. Last week, the company delivered an earnings and revenue beat, provided better-than-expected guidance for next quarter, and announced a $500 million buyback plan. Still, it wasn’t enough to drive the stock higher. Now, it sits on key support.

The stock is clearly out of favor right now, but is trying to find its footing in the $40 to $44 region. This has been a key support area so far in 2025 and going all the way back to its prior bear market lows in 2022. If support holds, bulls will look for a larger bounce to take hold. Should support break, more selling pressure could mount.

Options

As of November 7th, the options with the highest open interest for TTD stock — meaning the contracts with the largest open positions in the options market — were the November $35 puts, followed by the January $60 calls.

Remember, bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break. For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

There was one new record high in the Nasdaq 100 on Friday and that belonged to Monster Beverage. Shares climbed more than 5% on the day and were up as much as 9.5% at one point in the session. The company beat on earnings and revenue expectations, while delivering double-digit growth for both metrics. Dig into the fundamentals for MNST.

UnitedHealth Group, Molina Healthcare, Centene, Cigna and other health insurance providers are under pressure this morning despite US stock indices rallying. The decline comes as US President Trump posted negative commentary about the industry on social media, referring to them as “money sucking” health insurers and later called them “BIG, BAD Insurance Companies.” Check out the chart for UNH.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.