It’s a loaded week of jobs, inflation and retail sales. Plus, Walmart stock is navigating a fresh breakout. The Daily Breakdown dives in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Markets ended last week on a rough note. The S&P 500 fell 1.1%, the Nasdaq 100 dropped nearly 2%, and Bitcoin slipped 2.4%. Despite the Fed cutting interest rates and striking a neutral tone — neither overly dovish nor hawkish — risk-on assets still pulled back. The question now: can markets find their footing in the final full trading week of 2025?

Economic Data Is Back

The record-long U.S. government shutdown halted much of the country’s economic reporting, and even after reopening, data releases were still delayed. Now, the backlog is finally clearing. Tomorrow brings the October retail sales and the November jobs reports, offering a much-needed look at consumer strength and labor-market health. Later in the week, investors will get key inflation updates with the November CPI on Thursday and October PCE on Friday.

Earnings Trickle In

While earnings season is largely behind us, a handful of notable companies are still set to report. Lennar releases results Tuesday, followed by Micron on Wednesday. Cintas, Nike, and FedEx report Thursday, with Carnival Cruise closing out the week on Friday.

Want to receive these insights straight to your inbox?

The Setup — Walmart

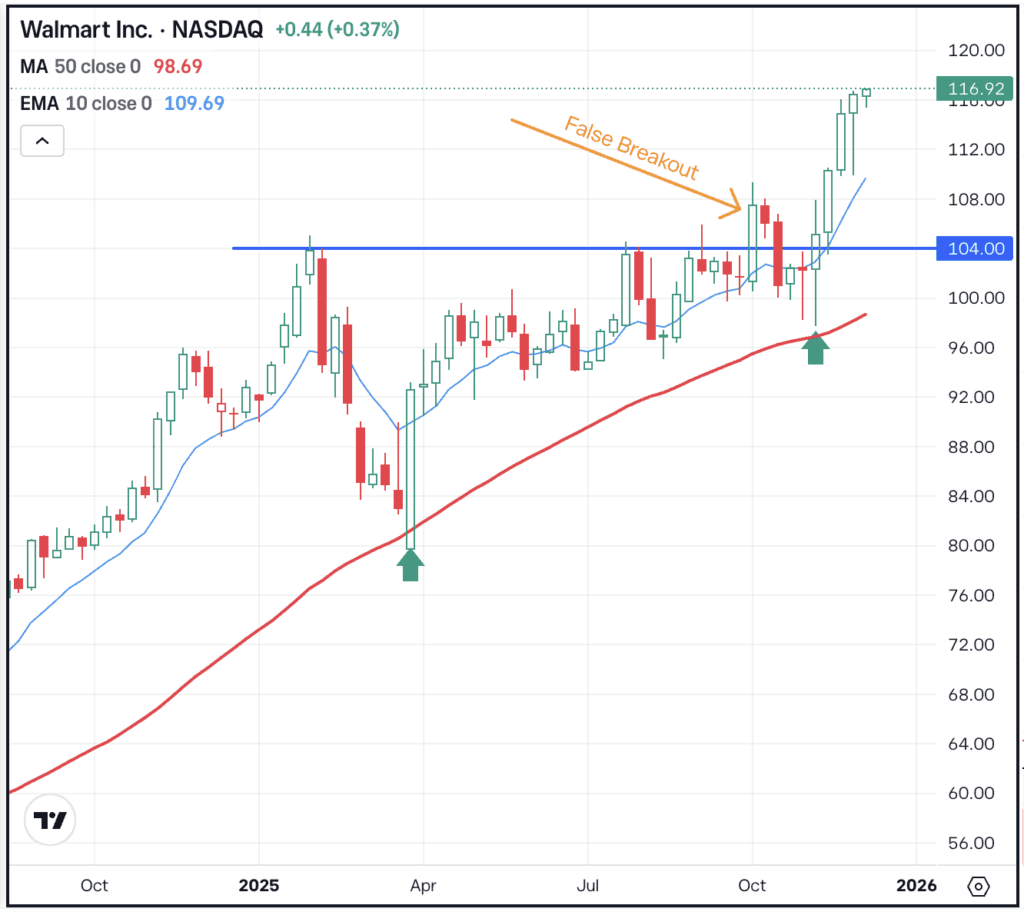

Earlier this year, Walmart tried to break out over the $104 level, which had become clear resistance in 2025. However, that breakout quickly failed, as shares retreated back toward $100. However, buyers continued to step in, keeping the upward trend intact as WMT held its 50-week moving average as support. Now, the more recent breakout over $104 has a bit more legitimacy.

After four straight weeks of gains, WMT stock may need to take a break and digest its latest gains. However, the breakout over $104 is clear, and bulls will look for this prior resistance area to turn into support. If it remains above this level, momentum can remain bullish. Below this level though and momentum can sour.

Options

On a dip, buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of ServiceNow are down about 5% in Monday’s pre-market session following reports that the company is exploring a $7 billion acquisition of cybersecurity startup Armis. With a market cap near $180 billion, ServiceNow could easily absorb the smaller firm, but the deal would be its largest ever. Armis was recently valued around $6.1 billion and has reportedly surpassed $300 million in annual recurring revenue. Dig into the fundamentals for ServiceNow.

Ethereum prices are up about 2.5% this morning as BTC, ETH and other leading cryptocurrencies try to regain momentum after last week’s dip from the highs. ETH briefly climbed above $3,400, but was able to stay above $3,000 on the ensuing pullback. Will it continue to do so this week? Check out the chart for ETH and remember, ETHA remains the largest Ethereum ETF by assets, while also supporting options trading.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.