The Daily Breakdown takes a closer look at silver, as the precious metal charges back to fresh highs. Econ data is back on the table.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

Stocks ended on a high note Friday, with the S&P 500 gaining more than 0.5%, the Nasdaq 100 climbing 0.8%, and both rallying for a fifth straight session. However, those gains are under pressure this morning with stocks taking a hit, while crypto faces a new wave of selling. Bitcoin is down more than 5% and Ethereum is down about 6%, while Solana, XRP, and others are also lower. It’s a tough start to December, but we’ll see how the day (and the week) shape up.

Earnings Keep on Rolling

We may have checked off a bulk of this year’s earnings reports, but a few notable names still linger. Tomorrow we’ll hear from CrowdStrike and American Eagle, while Macy’s, Dollar Tree, Salesforce, and Snowflake will report on Wednesday. Lastly, Dollar General, Kroger, and Hewlett Packard Enterprise will report on Thursday.

What Else to Watch?

With a Fed meeting coming up later this month, investors will be closely following this week’s economic data, which includes a labor market update — with Tuesday’s JOLTS report, Wednesday’s ADP report, and Thursday’s jobless claims report — as well as a key inflation update with Friday’s PCE figures.

Want to receive these insights straight to your inbox?

The Setup — Silver

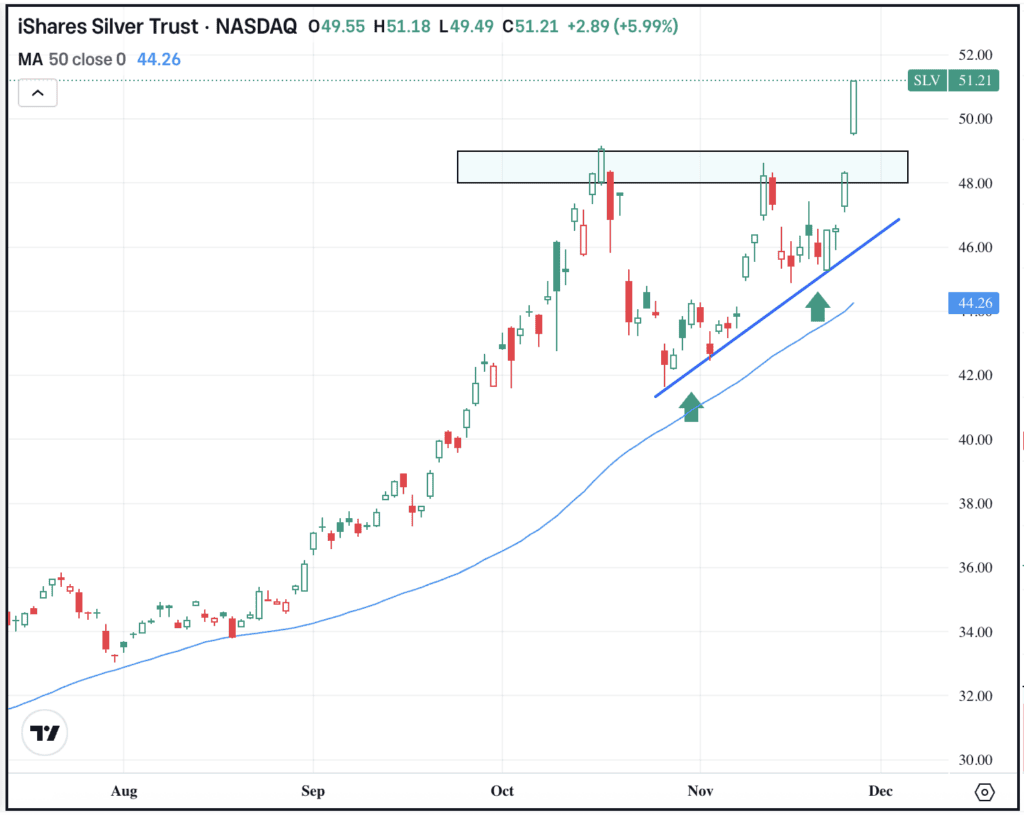

Silver has been heating up, as the metal surges to record highs. That helped send the SLV ETF higher by 13% last week, while shares are higher again this morning, up about 1.5% in pre-market trading. It has some investors wondering whether gold and the GLD ETF can move back to record highs as well.

The SLV ETF rallied into the $48 to $49 range in October and November, with both rallies ultimately hitting resistance. Now trading above this zone, bulls would like to see the $48 to $49 range become support moving forward. If it does, the technicals can remain bullish in the short- to intermediate-term.

Options

As of November 28th, the options with the highest open interest for SLV ETF — meaning the contracts with the largest open positions in the options market — were the January 2026 $50 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of GameStop are trending this morning, with the stock down about 2% in pre-market trading. GameStop hit a new 52-week low of $19.93 last week, but then enjoyed a 13% rally over the course of a five-day winning streak. Now traders question whether there’s any momentum left. Check out the charts for GME.

Alphabet climbed almost 7% last week and is now up more than 15% over the last two weeks. Its market cap now hovers just below the key $4 trillion mark, lagging only Apple and Nvidia. Will this remain a go-to Magnificent 7 stocks this month? Dig into the fundamentals for GOOGL.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.