Visa rallies on stablecoin optimism, while Micron pops on strong earnings. The Daily Breakdown dives into what’s moving markets.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

December’s options expiration arrives tomorrow — the final regular monthly expiration of the year. While options positioning isn’t the sole driver of stock moves, it can influence short-term market behavior. It’s possible the current positioning has contributed to some of the recent choppiness, especially as investors also process the Fed meeting and this week’s economic data. There’s no guarantee stocks rally after Friday’s expiration, but year-end seasonality combined with this catalyst could give the market a lift.

Inflation Gauge

The November CPI report will be released at 8:30 a.m. ET this morning. Markets are well aware that elevated inflation is preventing the Fed from becoming more accommodative — a dynamic likely to remain a key theme in 2026. Economists expect year-over-year CPI to come in at 3.1%, which would mark the third consecutive monthly increase and the fifth rise in six months, up from just 2.3% in May. A cooler-than-expected reading could lift markets, while a hotter print may push investors into a risk-off mindset as they reassess the threat of stubborn inflation.

Want to receive these insights straight to your inbox?

The Setup — Visa

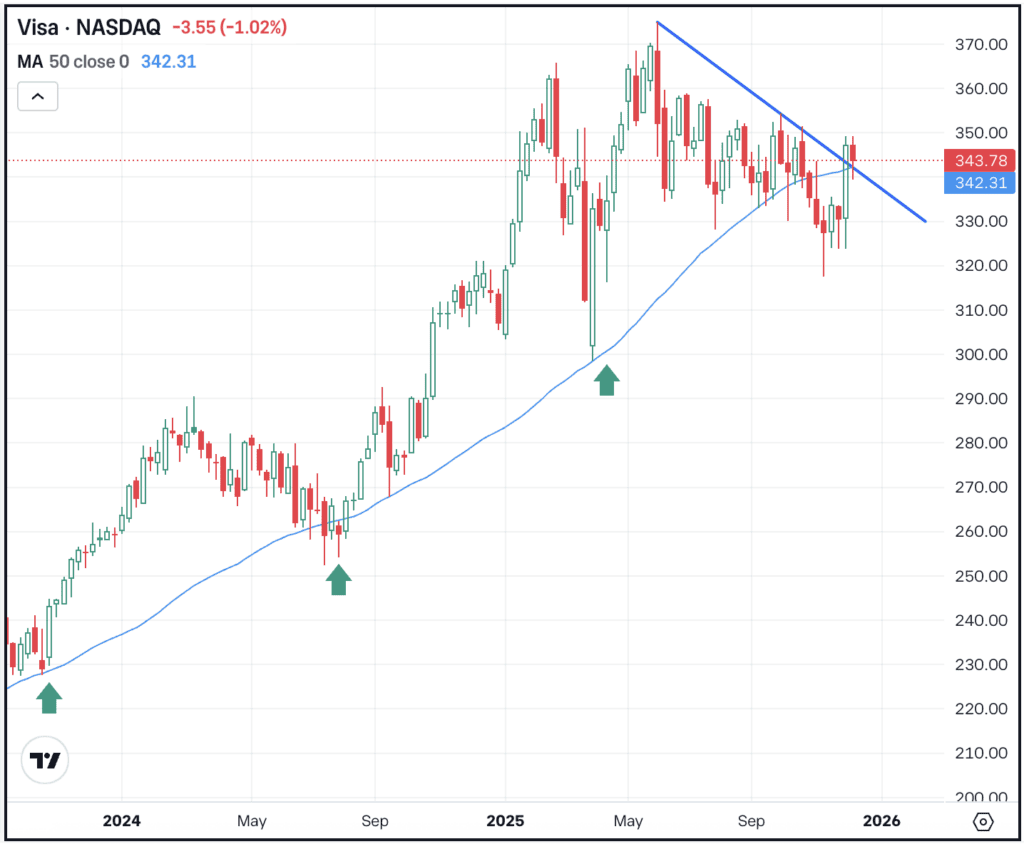

After hitting a record high in June, shares of Visa have been consolidating and drifting lower. This allowed the stock to work off its big rally over the last 12 to 18 months, while the valuation came down as well. However, the usually supportive 50-week moving average failed to hold as support in Q4, as bulls began to doubt Visa’s technical strength.

Now though, the stock has been rallying on optimism that stablecoins will benefit credit card companies like Visa and Mastercard, rather than hurt them.

With the ensuing rally, Visa has not only regained its 50-week moving average, but is attempting to clear current downtrend resistance. Should Visa stay above $340, more bullish momentum could come into play. But if shares break back below this level in a meaningful way, it could put the recent support area of $325 back in play.

Options

As of December 17th, the options with the highest open interest for V stock — meaning the contracts with the largest open positions in the options market — were the January 2027 $400 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Lululemon Athletica are rallying this morning, up close to 7% after activist investor Elliott Management reportedly built a position of more than $1 billion in the stock. The firm will push for changes that could help re-energize Lululemon’s business. Coming into Thursday’s session, shares were up more than 23% amid a three-week win streak. Check out the chart for LULU.

Micron stock is bursting higher today, up more than 13% in pre-market trading after the firm reported earnings on Wednesday. Earnings of $4.78 per share topped estimates of $3.82 a share, while revenue of $13.6 billion beat expectations of $12.8 billion. However, it was guidance that stole the show, with management calling for Q2 revenue in a range of $18.3 billion to $19.1 billion vs. estimates of just $14.4 billion. Even with today’s rally, top analysts still have a price target of ~$300.

Nike’s due to report earnings after the close on Thursday. Bulls hope they see a Micron-like response and a Lululemon-like multi-week gain. Nike, in the midst of its own turnaround efforts, is expected to report earnings of 37 cents per share on revenue of $12.2 billion — the latter of which would be slightly ahead of the tally delivered last December. Dig into the fundamentals for NKE.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.