The Daily Breakdown looks at the fall in PayPal, the rally in Palantir and tries to make sense of the market’s recent volatility.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

What’s Happening?

The Dow and Russell 2000 gained about 1% yesterday, while a little more than half of NYSE-listed stocks finished higher on the day. Precious metals remain volatile — gold was down nearly 5% on Monday but is up more than 5% this morning, while silver is up almost 10% — and Bitcoin is still trying to find its footing.

Government Shutdown

Many believe the partial government shutdown that went into effect over the weekend will be short-lived, but it’s already having an impact. On Monday, the Bureau of Labor Statistics announced it would postpone the release of this morning’s JOLTS report, as well as Friday’s monthly jobs report.

PayPal Falls, Palantir Jumps

As of Monday’s close, PayPal was down about 10% for the year ahead of this morning’s earnings report. Shares are now down more than 15% this morning after PayPal missed earnings and revenue expectations and announced that CEO Alex Chriss will be replaced by Enrique Lores.

Conversely, Palantir stock is up more than 10% after a better-than-expected quarter. Revenue surged 70% to $1.4 billion, while earnings of 25 cents per share also topped estimates. Guidance was strong as well: Palantir’s Q1 revenue outlook of $1.5 billion topped estimates of $1.3 billion, and its full-year outlook of $7.2 billion was well above consensus expectations of $6.3 billion.

Want to receive these insights straight to your inbox?

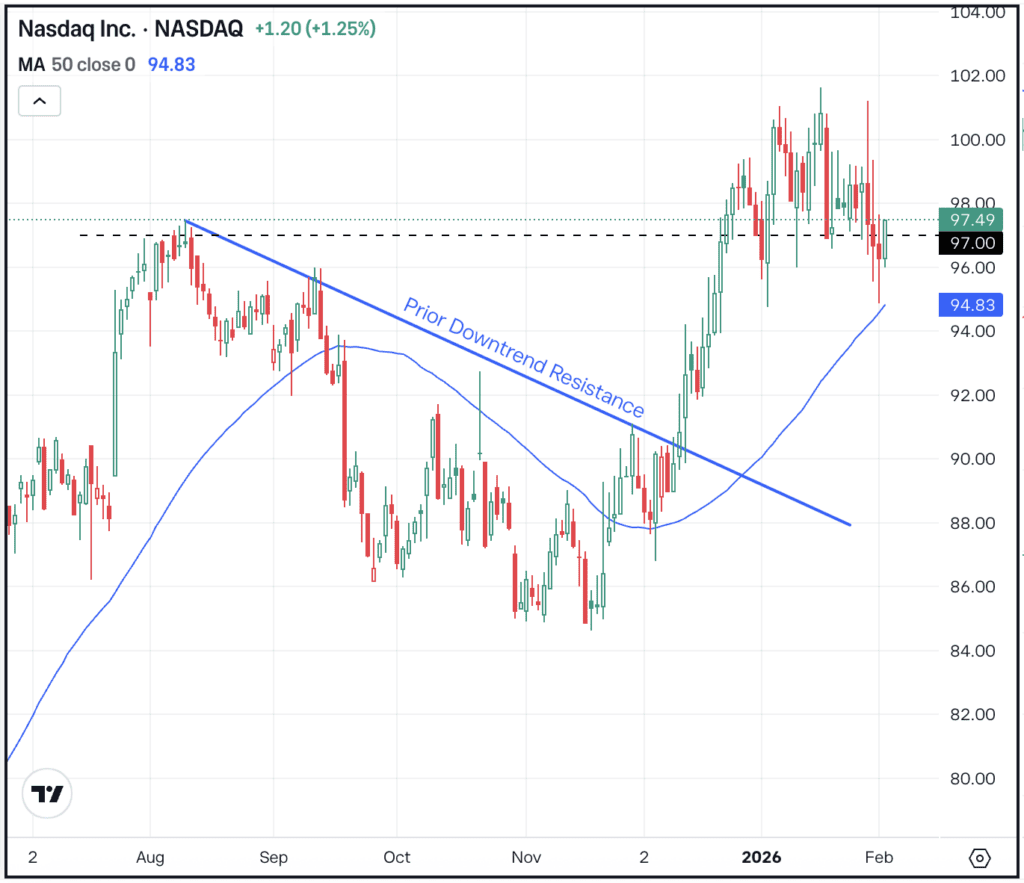

The Setup — Nasdaq Inc.

When investors think of the Nasdaq, their thoughts generally gravitate to the Nasdaq 100 — or the QQQ ETF — or the Nasdaq Composite. However, many forget that the Nasdaq exchange is also a business and a public company. As far as stocks go, this one has done pretty well.

In December, NDAQ was able to break out over prior downtrend resistance (blue line) and race to new highs just above $100. Since then, shares have pulled back to the rising 50-day moving average and have retested the prior resistance zone in the mid-$90s. Here, bulls are hoping this consolidation phase leads to higher prices. However, bears are hoping for support to break, sending shares lower.

Options

As of February 2nd, the options with the highest open interest for NDAQ stock — meaning the contracts with the largest open positions in the options market — were the June $110 calls.

Investors who are bullish could consider calls or call spreads as one way to speculate on further upside, while bearish investors could consider puts or put spreads to speculate on a further move to the downside. For options traders, it may be advantageous to have adequate time until the option’s expiration.

To learn more about options, consider visiting the eToro Academy.

What Wall Street’s Watching

Shares of Disney slipped more than 7% on Monday after the firm reported its fiscal Q1 results. Earnings of $1.63 per share beat estimates of $1.57 per share, while revenue of ~$26 billion beat expectations of ~$25.75 billion. However, CEO Bob Iger — who has stepped down before — will now be replaced by Josh D’Amaro. Dig into the fundamentals for DIS.

Ethereum was able to rally on Monday, up about 3% after a disastrous slide over the weekend. In fact, many other cryptos are in the same boat, with Bitcoin, Solana, XRP and others all trying to find their footing. ETF flows for Bitcoin were positive on Monday, while Ethereum ETF flows were basically flat. Now the question is, will the recent lows hold? Check out the chart for ETH.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.