Access the power of

CFD trading

Apply leverage, go short, and trade multiple assets with CFDs on eToro’s innovative, user-friendly platform

All the advanced features you need, from research and analysis to risk management

Leverage or short the most popular stocks, currencies, commodities and indices

Follow top traders to stay ahead of the curve and spot the next opportunity

The eToro Academy is your expert resource for trading courses, webinars and tutorials

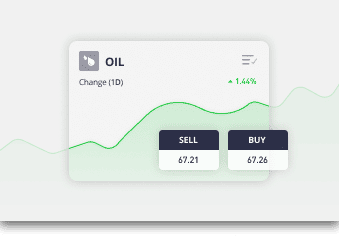

Diversify with ease on a multi-asset platform

Take advantage of all price movements — whether up or down – on a variety of assets from leading global markets

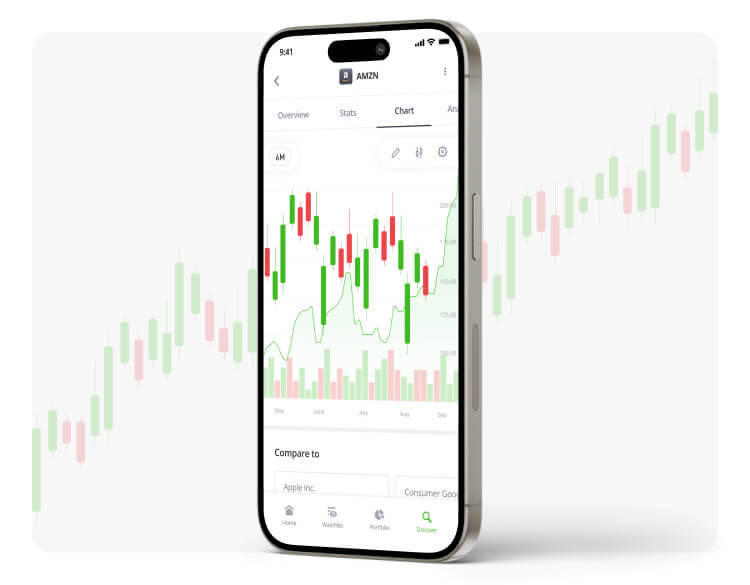

Pro Tools for Traders

eToro’s innovative platform is packed with user-friendly advanced features, designed to give you the edge when making important trading decisions on the fly

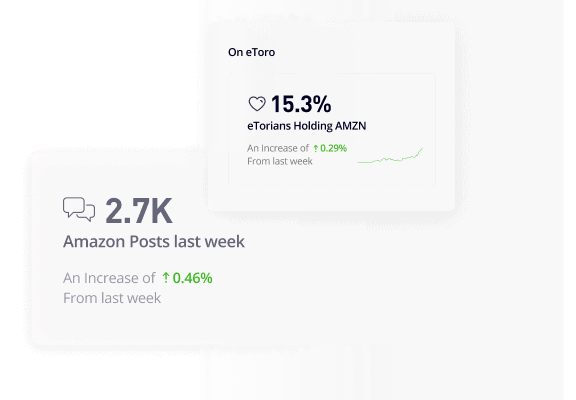

Stay ahead of the curve

In a trading community of millions of users, you can really feel when the sentiment changes. Follow the real-time moves of traders from over 100 countries and join the conversation as they discuss their strategies.

The knowledge to trade

Not sure where to start? Take less than 10 minutes to learn the basics

Take it for a test drive

Want to try CFD trading on eToro without risking any capital? Try it in demo mode. Every account includes a free $100,000 virtual portfolio for you to practise with.

FAQ

- What is CFD trading?

-

CFD trading is a method of trading the value of an underlying asset. The trader and broker enter into a contract whereby they agree to exchange the difference between the price of an underlying asset at the opening and closing of the trade. That is how the CFD gets its name, as it stands for “Contract for Difference” of price.

CFD trading allows investors to leverage their capital and provides many of the benefits of trading assets such as stocks, commodities, indices and crypto without actually owning the instrument or investing large sums of capital.

To learn more about CFD trading, click here.

- How do CFDs work?

-

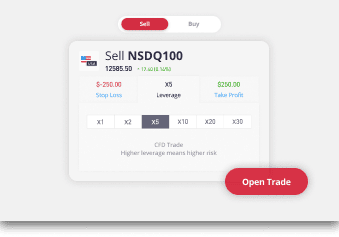

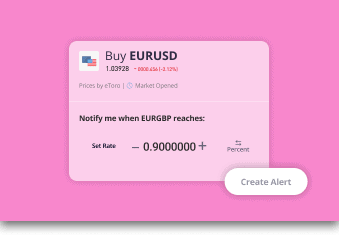

The trader chooses an asset offered as a CFD by the broker. It could be a stock, an index, a currency or any other asset to which the broker provides access.

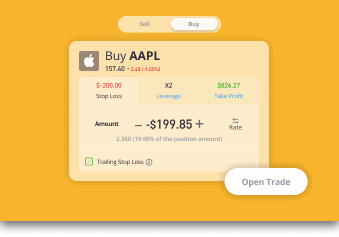

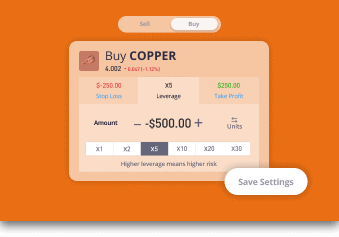

The trader opens the position and sets parameters such as whether it’s a long or short position, leverage size, invested amount (margin), stop-loss and other parameters, depending on the broker.

The broker will then state what the opening price for the position is, and whether or not additional fees (such as overnight fees) are involved.

The position is opened and remains open until either the trader decides to close it or it is closed by an automatic command, such as reaching a Stop-Loss or Take Profit point or the expiry of the contract.

If the position closes in profit, the broker pays the trader for the difference. If it closes at a loss, the trader pays the broker for the difference.

To learn more about how CFDs work, click here.

- What does “underlying asset” mean?

-

Some investment products, including CFDs, are derived from other financial assets. Underlying asset refers to the real financial asset — for example, the actual share of ownership in a stock, or a barrel of oil — on which the financial derivative is based. It is the value of the underlying asset that drives the value of the financial derivative. An underlying asset can be physically owned; a CFD cannot.

- Which assets can I trade as CFDs?

-

eToro offers CFD trading with currencies, commodities, indices, stocks, and cryptoassets (where available).

- What is leveraged trading?

-

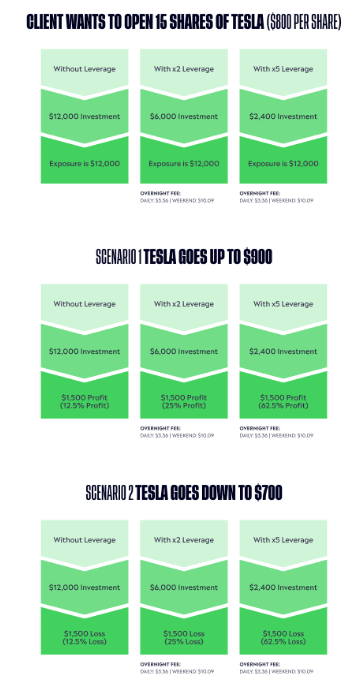

Sometimes traders may wish to gain a certain level of market exposure with minimal equity as part of their investment strategy. Trading with leverage means using capital which is a fraction of the position opened.

Leverage is applied in multiples of the capital invested by the trader, for example 2x, 5x, or higher. Leverage may be applied to both buy (long) and short (sell) positions.

For illustration purposes only.

It is important to note that any profits and losses will be calculated according to the total size of your position, not the capital invested. In other words, if you invest $100 in a position and apply 5X leverage, the total size of your position is $500 and, as such, profit or loss will be calculated according to the latter sum.

Using leverage enables you to lower the amount of capital you need to invest in order to trade (also called “margin”).

Changing your leverage level dictates how much margin is required to support your position.

If the market moves against you, your margin will cover your loss until the point your Stop- Loss is hit.

Using leverage requires a high level of involvement, as it is advisable to monitor your portfolio frequently.

For more information on leverage, click here.

- What is short selling?

-

“Short selling,” or “going short,” is a practice that enables traders who believe that an asset is overvalued, to open a position that will gain a profit in the event that the instrument’s price goes down. Short selling is also frequently used as a hedging tool.

- How can I use CFDs for diversification?

-

With CFDs, you have the ability to use leverage to lower the margin required to open the position. For example, say the price of one share of Google stock is $1,000, and you have $1,000 total available capital to invest. Trading using a CFD allows you to invest $100 in Google stock with 1:10 leverage, giving you an exposure of $1,000 to the asset without actually putting up $1,000 of capital. Since you only invested $100 in Google, this frees up the other $900 to invest in different assets, creating diversification.

- Is CFD trading legal?

-

CFD trading is legal in many countries. eToro offers CFD trading in Australia, France, Germany, Italy, the UK, and many other countries.

eToro is a regulated broker and authorised by CySEC, the FCA, and ASIC to provide CFD services.

- Is CFD trading safe?

-

Any financial investment involves risk, and CFDs are no different. CFD assets traded without leverage have the same risk as those assets traded directly. On eToro, for example, you can invest in any asset without applying any leverage. However, when trading CFDs with leverage, it is important to bear in mind that any losses as well as profits will be calculated according to the total size of your position, and not the capital invested. In other words, if you invest $100 in a position and apply 5X leverage, the total size of your position is $500 and, as such, profit or loss will be calculated according to the latter sum.

Using leverage requires a high level of involvement, as it is advisable to monitor your positions frequently. To learn more about how leverage works, click here.