The eToro platform stands out for its social trading features, offering innovative ways to invest by learning from others. Discover how CopyTrader™ can help you to explore new strategies and expand your trading potential.

Copy Trading Basics

The concept is simple: choose a trader, your investment amount, and hit “Copy.” However, this page will explain the system in greater detail.

Key terms to know:

- Copy: the action of copying another investor on eToro

- Copier: the user who is doing the copying

- Copied trader: the user being copied, also known as a Popular Investor. Only Popular Investors may be copied.

$200

Minimum investment per trader

$1

Minimum amount per copy position

$2,000,000

Maximum investment per trader

100

Maximum number of traders you can copy

Start a new copy

When you start a new copy, your position will match the current allocation of the copied trader’s portfolio, ensuring that both remain aligned. Copied portfolios replicate exact percentage allocations of the copied investor’s entire equity, including asset holdings, unallocated cash, and unrealised profit and losses.

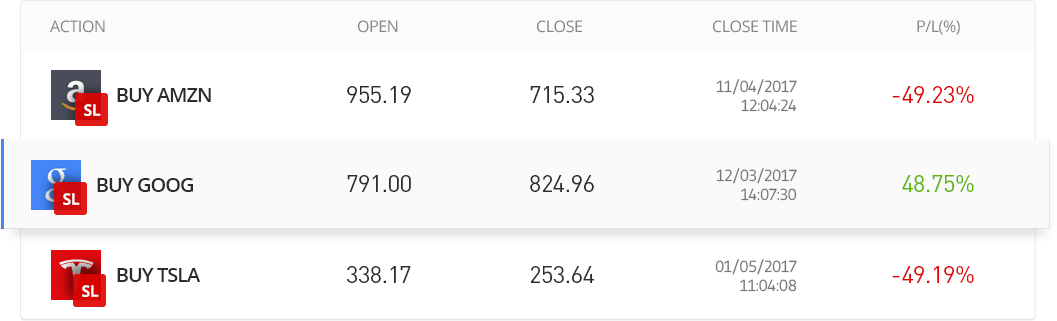

- From the moment you begin copying, your copy investment will mirror the copied trader’s current positions and future actions – including changes to Stop Loss (SL), Take Profit (TP), and trade closures. If the copied trader extends a SL by adding funds to a position, your SL will update as well, but your invested amount will remain unchanged.

- To view all of the trades copied from a single trader, go to your portfolio and click the Popular Investor’s name.

- You are able to close a specific copied trade without closing the entire copy position.

- If the copied trader opens a position while the market is closed (for example, during a market break), a Market Order will be placed for you and will execute at the first available market rate once the market reopens.

- You may choose to stop copying at any time

Please note: All trades included in the copy will open in your account simultaneously. You may initially see a slight loss, which reflects the spread between the Buy and Sell rates. This provides a real-time representation of the amount you would receive if you closed the trade immediately.

New trades are opened based on realised equity (your balance plus invested funds). For example, if the copied trader opens a trade using 10% of their realised equity, your copy will open the same trade using 10% of your realised equity.

Stay in sync, automatically

Automatic reallocation helps to keep your investment aligned with the portfolio of the trader you are copying. When the Popular Investor you are copying makes changes, your copy position is updated to ensure that your portfolio reflects the copied trader’s current positions and strategy.

Reallocation is triggered under the following conditions:

- Adding funds

- Removing funds

- Resuming a paused copy

- Withdrawals by the copied trader

- Deposits by the copied trader. Please note that this reallocation occurs with a delay of 48 hours, giving you time to add additional funds as well, if you wish.

- Market movements influencing the copied trader’s portfolio allocation will be reflected in the copy as well.

Note that existing positions may be automatically opened or closed to match the correct asset weightings, and profits or losses may be realised as a result of these automatic adjustments.

While reallocation is in progress, you will not be able to add or withdraw funds, close individual positions, or pause the copy. This allows the system to fully match the updated portfolio of the copied trader.

You will receive an in-app notification once reallocation is complete. The process is completed in up to 7 business days, after which you can resume managing your copy as usual.

Control risk with Copy Stop-Loss

Copy Stop-Loss (CSL) is a built-in risk management feature that lets you set a stop-loss percentage across the entire copy trade to help protect your investment based on real-time profit and loss. If the value of your copy drops below the set amount, the system will automatically close the copy and return the remaining funds to your balance.

- By default, CSL is set to 40% of your invested amount.

- You can manually adjust CSL to any value between 5% and 95% of your invested amount.

Example: You copy Trader A with $1,000. You set CSL at 60%, which equals $600. If the total equity (including unrealised P/L) drops to $600, all positions will close automatically, and $600 will return to your balance.

Please note that the system will not allow you to reduce the CSL to a value that is so small that it could trigger the closure of the copy trade immediately. Also, adding or removing funds from the copied trader will trigger a recalculation of the CSL value as a percentage of the new copy amount.

What happens when CSL is triggered?

When your copy reaches the CSL threshold due to unrealised losses, all positions in that copy relationship will close. In your History tab, closed trades will be labelled “CSL.”

How Copy Stop-Loss is unique

The CSL is designed to limit your overall exposure to any one trader. Since your copied trades are protected by the CSL, we can allow for more flexibility when it comes to their Stop Losses (SL).

With regular trades, increasing the SL beyond the minimum required means additional funds are pulled from your balance to support the trade. With copied trades, when the copied trader extends their SL, no additional funds are deducted from your copy amount. This means that:

- A single trade can go 200% or even 300% into loss without being stopped, giving it a better chance to recover.

- Your copy balance retains enough funds to support additional trades.

However, if the overall unrealised loss in the copy relationship reaches your set CSL, all positions will close and the copy relationship will end. The copied trade’s gain/loss is calculated according to the original amount invested in the trade.

Adjust your investment anytime

You can increase your copy investment at any time by adding funds, which will be proportionally adjusted within your portfolio. Similarly, you have the option to remove funds from the copy (maintaining the copy’s minimum investment), which will be moved back to your available cash balance. (As noted above, adding to or removing funds from a copy position does trigger automatic reallocation.)

Stop copying – or just press pause

You are always in control of your investments, and you can stop copying at any time.

Bear in mind that you can close specific trades within a copy position without closing the entire copy. The funds from this position will be credited back to your copy balance.

If you wish to stop copying a trader altogether, choose “Stop copying” from the copy settings menu. You will then have two choices:

- Sell All closes the copy entirely.

- Keep All transfers all copied positions to your own portfolio, where they can then be managed independently

Pause Copy is a feature that allows you to stop copying a trader without closing all of the currently opened positions.

When a copy is paused, there will be no new trades opened, but all of the already open trades will still be copying the SL/TP and close actions from the copied trader. Pause copy can be activated from the portfolio page on eToro by clicking on the settings button and “Pause Copy.”

You can resume the copy at any time by heading over to the portfolio page and clicking “Resume Copy.”

Copy smarter with expertly curated portfolios

Smart Portfolios are innovative, long-term investment portfolios built on the same CopyTrader technology, meaning your investment automatically mirrors the portfolio’s allocation and strategy. Each one follows a unique theme, offering a convenient and diversified way to invest in major market trends shaping the world today – all without the usual management fees.

- The minimum investment amount is as low as $500.

- The default Stop Loss for a Smart Portfolio is set at 10%.

- The weights allocation of each Smart Portfolio can change over time, as each is rebalanced regularly.

There are several different types of Smart Portfolios:

Market Smart Portfolios bundle multiple assets into a single investment product, each following a defined market strategy or targeting a specific sector. For example, the BigTech Smart Portfolio includes leading tech companies, offering a convenient, yet diversified way to invest in the entire sector through one asset.

Top Trader Smart Portfolios group high-performing traders, selected by eToro’s investment committee using a sophisticated algorithm, into a single investment. For example, the GainersQtr Smart Portfolio includes traders with consistent returns and strong short-term potential, updated regularly to manage risk and optimise performance.

Partner Smart Portfolios are created in collaboration with some of the most innovative investment start-ups, money managers and data research companies in the world. For example, Target Model Smart Portfolios were created in partnership with Franklin Templeton to incorporate target year investing strategies that adjust automatically over time.

*All CopyTrader terms and conditions are subject to change at eToro’s discretion, at any time.